Should Americans Be Insuring Their Retirement?

With continuing volatility in the financial markets and interest rates hovering at unprecedented lows, preparing for retirement has become a conundrum for Americans today. The big question: how can you protect your money from market downturns, but also provide adequate growth to reach your retirement goals? This paper explores the advantages of insuring retirement income, just as you insure other valuable assets. It examines the financial risks today’s retirees face, and provides a case study on the potential impact of leaving funds for retirement unprotected. In addition, the paper touches on some of the products that can be used to insure retirement assets and provide guaranteed income that can last a lifetime.

The Role of Insurance

Insurance plays a critical role in American society today.

It’s common for many of us, either by choice or requirement, to insure our most valuable assets in order to safeguard against significant financial loss. The benefits of insurance, or protecting assets, can help Americans on two basic levels.

- Insurance can help provide some level of peace of mind

- Insurance can provide protection for covered assets should a severe risk event occur

Valuable – But Often Overlooked – Assets

While most of us don’t think twice about insuring certain physical assets that would be expensive to replace, there are two valuable, but far less tangible, assets that could benefit from the type of protection insurance can deliver:

- An individual’s ability to work and generate income

- An individual’s ability to generate income when no longer working

The ability to work and earn income over a lifetime is referred to as “human capital” by economists. As a simple example, if a 45-year-old worker is expected to earn $100,000 annually for the next 20 years until retirement at age 65, his or her human capital would be worth $2,000,000 (ignoring the time value of money). Human capital is often a large economic asset, and the financial implications of being unable to work can be severe. Assuming jobs are available, there are two main risks to a worker’s ability to generate income:

- Premature death

- Disability

Although the likelihood of either of these events occurring in a given year is small, the financial impact if one of them did occur would be significant.

Insurance can mitigate these risks. In the event of premature death, the income that would have been generated by one’s ability to work can be protected by life insurance. In the event of a disability that limits the ability to earn a living over a prolonged period of time, that income can be protected by disability insurance. Therefore, financial professionals will usually recommend that individuals insure their ability to generate income while they are employed.

For most individuals, the value of their human capital will decline over time as the number of future working years declines, while the value of their financial assets will increase from ongoing saving and investment returns. Financial assets that individuals might acquire over time include: investments in stocks, bonds, mutual funds, and annuities; savings in retirement plans, such as 401(k)s and IRAs; bank deposits; and home equity.

Upon retirement, individuals switch from relying on their ability to work to generate income to relying on their financial assets to generate income.

Income generated from financial assets supplements income from other sources in retirement, such as Social Security benefits and pension benefits from a former employer.

Risks to Financial Assets in Retirement

Just as there are risks that can impact the ability to generate a paycheck during working years, there are risks that impact the ability to generate lifetime income from financial assets during retirement years. These include longevity risk, market uncertainty, and an extended period of low interest rates.

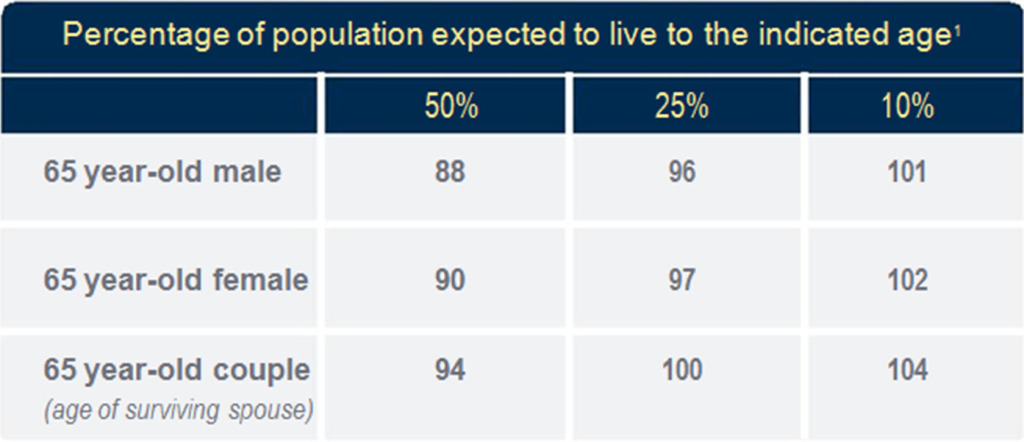

Longevity risk is the risk that an individual outlives his or her financial assets. As shown in the table below, a 65-year-old male has a 50% chance of living to age 88 and a 10% chance of living to nearly 101.

For a married couple aged 65, there is a 50% chance that at least one spouse will live to 94, and a 10% chance that one will live to 104.1

Market uncertainty is the risk that poor market returns may drive down the value of an investment portfolio and, in turn, the income that the portfolio can generate. Although poor returns can occur at any time, market uncertainty is a much greater risk in the years just before and just after retirement because investors have less time to recover from any losses. Poor investment returns in the years just before retirement can force an individual to postpone retirement. Similarly, poor returns early in retirement can have a devastating impact on a portfolio’s ability to generate income over the long run.

An extended period of low interest rates is another issue of concern. Many retirees prefer to invest in conservative

investments, such as bank certificates of deposit and money market accounts, because these investments are relatively safe and many retirees are risk-averse. However, if interest rates and yields are low for extended periods, retirement assets will have little investment growth, and are at risk

of being exhausted earlier than expected.

Social Security and Pensions

Some forms of retirement income, namely Social Security and traditional pensions, have built-in protection against longevity risk, market uncertainty, and an extended period of low interest rates. Social Security is designed to provide benefits for a retiree’s lifetime, no matter how long the retiree lives and regardless of stock market performance and interest rate levels.

Workers who retire with income from defined benefit plans (pensions) have similar protections to those that exist with Social Security. However, pensions are much less common than they were a few decades ago, as many employers have transitioned to defined contribution plans, such as 401(k)s, which place greater risk and responsibility on the individual.

The number of active participants in private employer-defined benefit plans dropped from 27 million in 1975 to 18 million in 2009, a decrease of 33%. Over the same period, the number of active participants in defined contribution plans soared 542% from 11 million to 72 million.2 (see Figure 1)

Unlike income generated from defined benefit plans, income from defined contribution plans and other personal savings and investments does not enjoy protection against longevity risk, market uncertainty, or an extended period of low interest rates unless individuals put such protection in place.

CASE STUDY – The Potential Impact of Unprotected Retirement Assets

CASE STUDY – The Potential Impact of Unprotected Retirement Assets

To understand the impact that longevity risk, market uncertainty, and an extended period of low interest rates can have on the ability of unprotected financial assets to generate retirement income, it is helpful to look at a case study. Prudential developed the following case study; supporting research was provided by Ernst & Young’s Insurance and Actuarial Advisory Services practice.

The case study focuses on a hypothetical new retiree, Jean. Jean’s retirement outcomes were generated using Ernst & Young’s Retirement Analytics™ model, which projected 2,000 Monte Carlo simulations of investment returns, interest rates and lifespans.3

The Results

The results of the case study show that there is a significant chance of exhausting assets in retirement – and therefore the income those assets generate – due to market volatility, low interest rates, and higher than expected longevity.

The results were based on three specific scenarios:

Scenario 1: an environment with no market volatility or longevity risk Scenario 2: an environment with both market volatility and longevity risk

Scenario 3: an environment with market volatility, longevity risk, and an extended period of low interest rates

Scenario 1

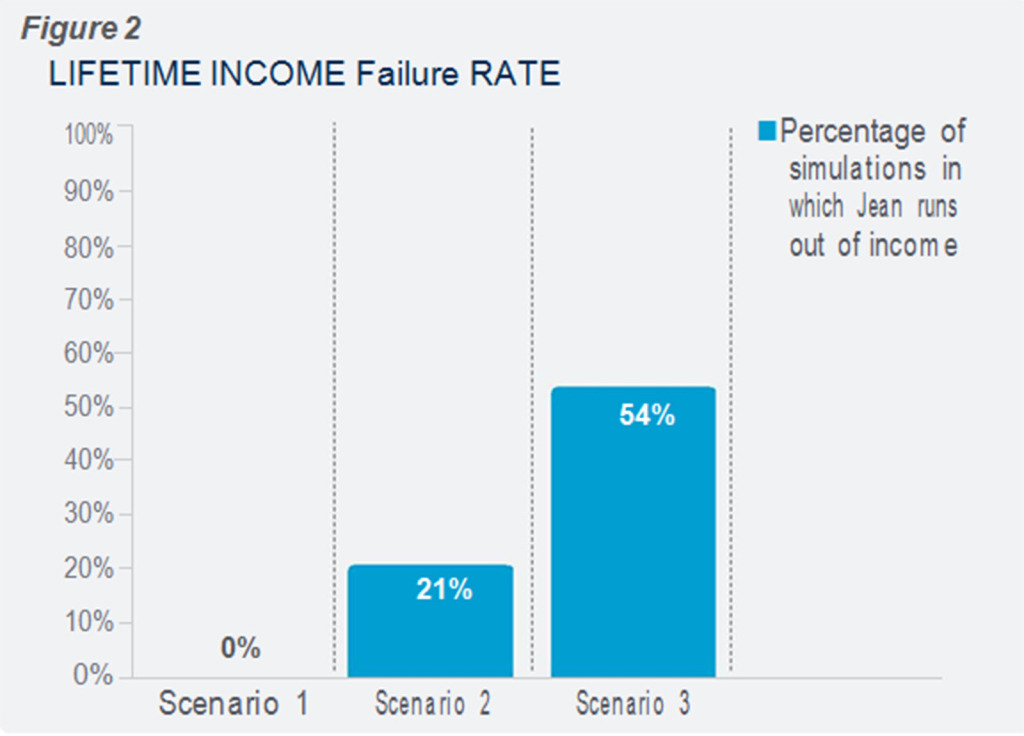

As you can see in Figure 2, if Jean’s retirement outcomes are modeled with a standard gross investment return of 8% each year (i.e., no equity or bond market volatility), and she is assumed in each simulation to live to her life expectancy age of 906 (i.e., no variability with respect to longevity), Jean will never run out of income, as her net investment return of 7% (after fees are deducted) exceeds her 5% annual income withdrawal amount. Moreover, her principal remains intact, and even increases incrementally each year.

Scenario 2

Of course, it is unrealistic to assume that Jean receives a gross return of 8% each and every year, or that she is certain to live to her life expectancy. Investment returns do vary from year to year, and Jean may live longer or shorter than average. If market uncertainty and longevity risk are introduced into the model, by allowing the model to vary investment returns and lifespan, Jean’s assets are depleted in 420 of the 2,000 simulations. As a result, her failure rate rises to 21%.

SCENARIO 3

As noted earlier, another aspect of market uncertainty is the possibility of interest rates remaining low for an extended period of time. Japan has experienced this for the last two decades (the yield on 10-year Japanese government bonds has averaged 2.13% from 1992 through 20117). Interest rates in the U.S. have been low for more than 3 years. Scenario 3 reflects the possibility that U.S. interest rates remain at their December 31, 2011 levels throughout Jean’s retirement. In this scenario, Jean’s assets are depleted in 1,080 of the 2,000 simulations, translating to a failure rate of 54% (see Figure 2).

The Severity of an Average Lifetime Income Shortfall

Figure 3 illustrates Jean’s income shortfall in each of the three scenarios. In Scenario 1, Jean achieves her goals without an income shortfall. However, in Scenarios 2 and 3, more ominous situations emerge. In Scenario 2, the average lifetime income shortfall for the simulations in which Jean runs out of income is $158,170 over her remaining years – which translates into more than 10 years without the extra $15,000 in income she had planned.

The most severe cases reveal even more about the income risk Jean faces. In the worst 10% of the 2,000 simulations studied, Jean’s average lifetime income shortfall for Scenario 2 grew to $256,815 – or 17 years without the extra income on which she was counting.

In Scenario 3, when an extended period of low interest rates is layered onto market volatility and longevity risk, the average lifetime shortfall for the simulations in which Jean runs out of income is $161,136, which translates to over 10 years without extra retirement income. In the worst 10% of simulations, Jean’s shortfall is $348,428 – or an astounding 23 years without her anticipated income.

Insuring Retirement Income

Similar to loss or damage to physical assets, longevity risk, market uncertainty, and an extended period of low interest rates can create significant financial hardship for retirees.

Social Security and traditional pensions offer some income protection against these risks in that payments continue no matter how long an individual lives and regardless of stock market performance and interest rate levels. However, for other types of financial assets that will serve as sources of retirement income, individuals should consider putting additional risk protection in place. By purchasing an insurance product designed to help manage the risks we saw in Jean’s experiences, namely, longevity, market uncertainty, and low interest rates risks, individuals can have an added layer of protection.

Today’s Guaranteed Lifetime Income Products

Over the last decade, insurers have developed new types of guaranteed lifetime income products, in the form of variable annuities with optional guaranteed lifetime income benefits. These benefits, which are available for an additional fee, help meet the needs of today’s retirees.

These guaranteed income products help ensure that financial assets can deliver a stream of income that cannot be outlived, even in the case of very poor investment returns or extremely long lifespans.8

Individuals can utilize these products prior to retirement to protect their future income from market downturns. These guaranteed lifetime income products are also used during retirement to ensure that income will be generated for life no matter how long a retiree lives, how the stock market performs, or whether interest rates remain low for prolonged periods.

It’s important to note that, while income is protected, the account value is not guaranteed, can fluctuate, and may lose value. If the financial assets invested in the guaranteed lifetime income product are depleted, the insurance company will continue to make payments to the individual for life.

More Control and Flexibility

Unlike some annuities, variable annuities with optional guaranteed lifetime income benefits do not require retirees to surrender control of their assets to the insurance company in exchange for a guaranteed stream of payments. Rather, the retiree maintains access to the assets invested in the variable annuity, while still receiving guaranteed income for life. The financial assets can typically be invested in a wide selection of investment portfolios. Furthermore, income can be stopped, started, or adjusted at any time. However, if the retiree withdraws an amount in excess of the guaranteed income payment, this will typically reduce future guaranteed income payments proportionately. If the retiree’s excess withdrawal reduces the account value to zero, no further amount would be payable under the benefit and the contract would terminate. Also, unlike some annuities, any assets remaining in the variable annuity account upon the death

of the annuity contract holder are passed to a beneficiary.

Similar to other types of insurance, there is a cost for the optional guaranteed lifetime income benefit. Before investing in a variable annuity with a guaranteed lifetime income benefit, Americans should:

- Consider the likelihood that their assets may not produce the income they will need throughout retirement

- Determine how severely an income shortfall would impact their lifestyle as they age

- Weigh the value of retirement income protection – balancing the fees and the protection provided

With income protection in place, retirees will no longer need to worry that the income being generated from their financial assets will be exhausted, regardless of how long they live or how their investments perform.

In a recent study 82% of individuals thought guaranteed investment products would be a perfect addition or “nice to have” for their retirement portfolio.9

Summary

- Individuals routinely insure valuable assets; however, far fewer insure their ability to generate lifetime income.

- During the working years, an individual’s most valuable asset is often the ability to work and generate income. The two main risks to being able to generate income are premature death and disability. Individuals can insure themselves against the impact of these risks.

- When approaching and then entering retirement, an individual’s most valuable asset may be the savings from which he or she must generate retirement income. Three significant risks to being able to generate that income are longevity risk, market uncertainty, and an extended period of low interest rates.

- As seen in the case study, the impact of these three risks can be severe and retirees can find themselves with a substantial income shortfall should their assets be exhausted.

- The good news, however, is that individuals can help protect themselves against the impact of these kinds of risks as well.

- Guaranteed lifetime income products can provide this protection, and, like other types of insurance, can also help provide some level of peace of mind.

While goals and needs may change over a lifetime, income can be – and perhaps should be – protected at every step along the way.

Investors should consider the contract and the underlying portfolios’ investment objectives, risks, charges and expenses carefully before investing. This and other important information is contained in the prospectus, which can be obtained from your financial professional. Please read the prospectus carefully before investing.

Variable annuities are issued by Pruco Life Insurance Company (in New York, by Pruco Life Insurance Company of New Jersey), Newark, NJ and distributed by Prudential Annuities Distributors, Inc., Shelton, CT. All are Prudential Financial companies and each is solely responsible for its own financial condition and contractual obligations. Prudential Annuities is a business of Prudential Financial, Inc.

Annuity contracts contain exclusions, limitations, reductions of benefits and terms for keeping them in force. Your licensed financial professional can provide you with complete details.

A variable annuity is a long-term investment designed for retirement purposes. Investment returns and the principal value of an investment will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original investment. Withdrawals or surrenders may be subject to contingent deferred sales charges. Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 59½, may be subject to an additional 10% federal income tax penalty, sometimes referred to as an additional income tax. Withdrawals, other than from IRAs or employer retirement plans, are deemed to be gains out first for tax purposes. Withdrawals reduce the account value and the living and death benefits.

Optional benefits may not be available in every state and may not be elected in conjunction with certain optional benefits. Optional benefits have certain investment, holding period, liquidity, and withdrawal limitations and restrictions. The benefit fees are in addition to fees and charges associated with the basic annuity.

All guarantees, including the benefit payment obligations arising under the annuity contract guarantees, rider guarantees, optional benefits, any fixed account crediting rates or annuity payout rates are backed by the claims-paying ability of Pruco Life Insurance Company and Pruco Life Insurance Company of New Jersey. Those payments and the responsibility to make them are not the obligations of the third party broker/dealer from which this annuity is purchased or any of its affiliates. All guarantees, including optional benefits, do not apply to the underlying investment options.

CDs are FDIC-insured up to $250,000 per financial institution. There may be a penalty for early withdrawal. Annuities, like many investments, are not FDIC-insured, and returns may fluctuate and be worth more or less than the total purchase payments. Annuities have fees, expenses, annual administration and insurance charges. Annuities also have limitations and withdrawal charges. Withdrawals may be subject to ordinary income tax and a 10% federal income tax penalty if taken prior to age 59½.

Dow Jones Corporate Bond Index (DJCI) captures the return of readily tradable high-grade U.S. corporate bonds. The subsets of the index capture the returns of the three bond market sectors: Industrial, Financial, and Utilities/Telecom.

S&P 500® Index is a market capitalization-weighted index of the 500 widely held stocks often used as a proxy for the stock market. S&P chooses the member companies for the 500 based on market size, liquidity and industry group representation.

© 2013 Prudential Financial, Inc. and its related entities. Prudential Annuities, Prudential, the Prudential logo, the Rock symbol, and Bring Your Challenges are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.