Why focus on regaining lost market value to due to volatility, when you can build new value with a FIA?

The advantages of a fixed index annuity (FIA) with annual reset

This is not a comprehensive overview of all the relevant annuity features and benefits. Be sure to review all material details about these products.

Chart #1

The above time period was chose as an example to illustrate two complete cycles of recent volatility in the S&P 500® Index from 1/1/2000 to 1/1/2013.

How will the value of your retirement assets respond to market volatility?

Consider the following points:

At the beginning of 2000, the S&P 500® benchmark Index stood at 1,469. Twelve years later it ending value was 1,426. Looking at those two numbers, you might conclude that those invested in the S&P 500® saw a change of only -2.9%, and that the S&P 500® Index basically “didn’t do much” during that time frame.

But that really wasn’t the case. As you can see there were periods of volatility in the S&P 500® Index during those 12 years. Showing periods of increasing value, as well as periods of declining value.

In fact, the S&P 500® more than doubled in value twice (the green line) – and experienced drops that lost approximately half its value twice (the red lines).

Although an external index may affect your interest credited, the contract does not directly participate in any equity or fixed income investments. You are not buying shares in an index. The index value does not include the dividends paid on the equity investments underlying any equity index. These dividends are not reflected in the interest credited to your contract.

You may think that the only way to earn a positive net gain during such periods of volatility like this is to try and “time the market.” In other words, you could attempt to enter the market just before an up cycle begins, and then get out just before a down cycle begins.

If predicting the market was that easy, anyone could do it!

Fortunately, with a FIA, you don’t have to worry about your ability to time the market, because fixed-indexed annuities (FIAs) can protect value during such periods of volatility.

Fixed-indexed annuities, “FIAs”, can protect your contract value, even during periods of volatility.

Fixed-indexed annuities can help you meet your long-term retirement needs by protecting value in volatile times. In addition to protecting your principal, they provide tax deferral, and guaranteed lifetime income. Plus, your beneficiaries may receive the residual value of your fixed-indexed annuity contract as a death benefit.

With a FIA, you have the opportunity to receive interest based on positive changes in an external index such as the S&P 500® Index. That means you cannot lose value due to negative index performance. Your principal and credited interest are locked-in and protected during periods of index decline. In other words, you’re not actually invested in the market, but you can receive interest based on your chosen index’s annual performance.

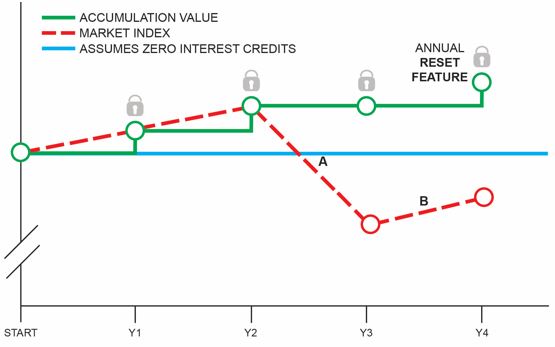

Chart #2

This hypothetical example is provided for illustrative purposes only and does not reflect any surrender charges or rider fees that may be assessed. If there is no indexed interest, the value would be the money you put into the annuity.

A The index increases in year 1 and year 2 , and then drops in the 3rd year as shown (Red dotted line), but your accumulation value (Green line) holds steady.

B Following a year of negative index performance in the 3rd year (Red dotted line), that year’s ending value becomes the FIA’s starting value for the next year (Green line) . As the market heads up in year 4 (Red dotted line), you can see that the FIA’s accumulation value moves higher (Green line). This example is demonstrating that a FIA policy holder does not have to make up previous index losses before the FIA annuity (Green line) can earn additional interest, and move higher.

Note that indexed interest potential may be limited by the crediting method chosen, as well as factors such as caps, spreads and/or participation rates. Be sure to fully review the product information before making any purchasing decision.

The annual reset feature can build value following any contract year in which the index experienced positive performance – even when the index has not recovered previous lost value.

How do they do that?

Annual reset is a common FIA feature. At the end of each contract year, your annuity’s index values are automatically reset. That means this year’s ending value becomes next year’s starting value. The annual reset feature locks in any annual interest gains your contract earns in any year the index experiences a positive performance.

How can that be so?

The design of the FIA with the annual reset feature (available on most FIAs) looks only at the index change during that individual contract year. So if the index performance is positive for a particular year (as measured by your chosen crediting method), your FIA contract will receive an interest credit based on the growth from the most recent “reset base.”

The annual reset design of the FIA provides a powerful combination of protection and interest opportunity, giving consumers the potential to grow the value of their assets, even in years when it looks like the index “didn’t do much” .

For interest potential and protection from market volatility, talk to your financial professional about putting a portion of your retirement assets in a fixed index annuity.

S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”). This trademark has been licensed for use by S&P Dow Jones Indices LLC and its affiliates. S&P® and S&P 500® are trademarks of S&P.

No single crediting method consistently delivers the most interest under all market conditions. With the purchase of additional cost riders, the contract’s value will be reduced by the cost of the rider each contract year. This may result in a loss of principal in any contract year in which the contract does not earn interest or earns interest in an amount less than the rider charge.

Surrender charges may apply if you do not meet the terms of your contract. These charges may result in a loss of indexed interest and fixed interest, and a partial loss of premium.

Guarantees are backed by the financial strength and claims paying ability of the issuing carrier.

Product and feature availability varies by carrier and state.