FIXED INDEXED ANNUITIES: RECAP…AND WHAT’S NEXT?

AUTHOR

Guillaume Briere-Giroux

FSA, MAAA, CFA

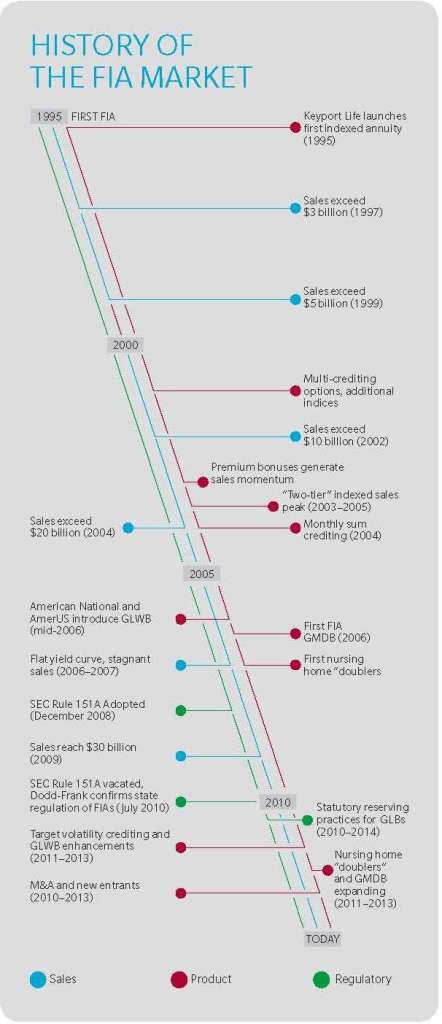

Growing sales and a flurry of M&A deals have put a brightening spotlight on fixed indexed annuities (FIA). From 2007 to 2013, despite near-record low interest rates, FIA annual sales growth averaged nearly 8% and their share of the overall annuity market grew from 9.7% to 17.1% (source: LIMRA). Also drawing attention were the numerous M&A deals that have taken place in the last several years (Exhibit 1). Changes in the FIA space have been rapid and profound and insurance carriers, industry analysts, regulators and distributors alike have taken notice.

This article recaps the formidable changes that have shaped the FIA market since its humble beginnings in the mid-1990s and offers a perspective on ten emerging developments to watch in 2014 and beyond.

FIA MARKET RECAP

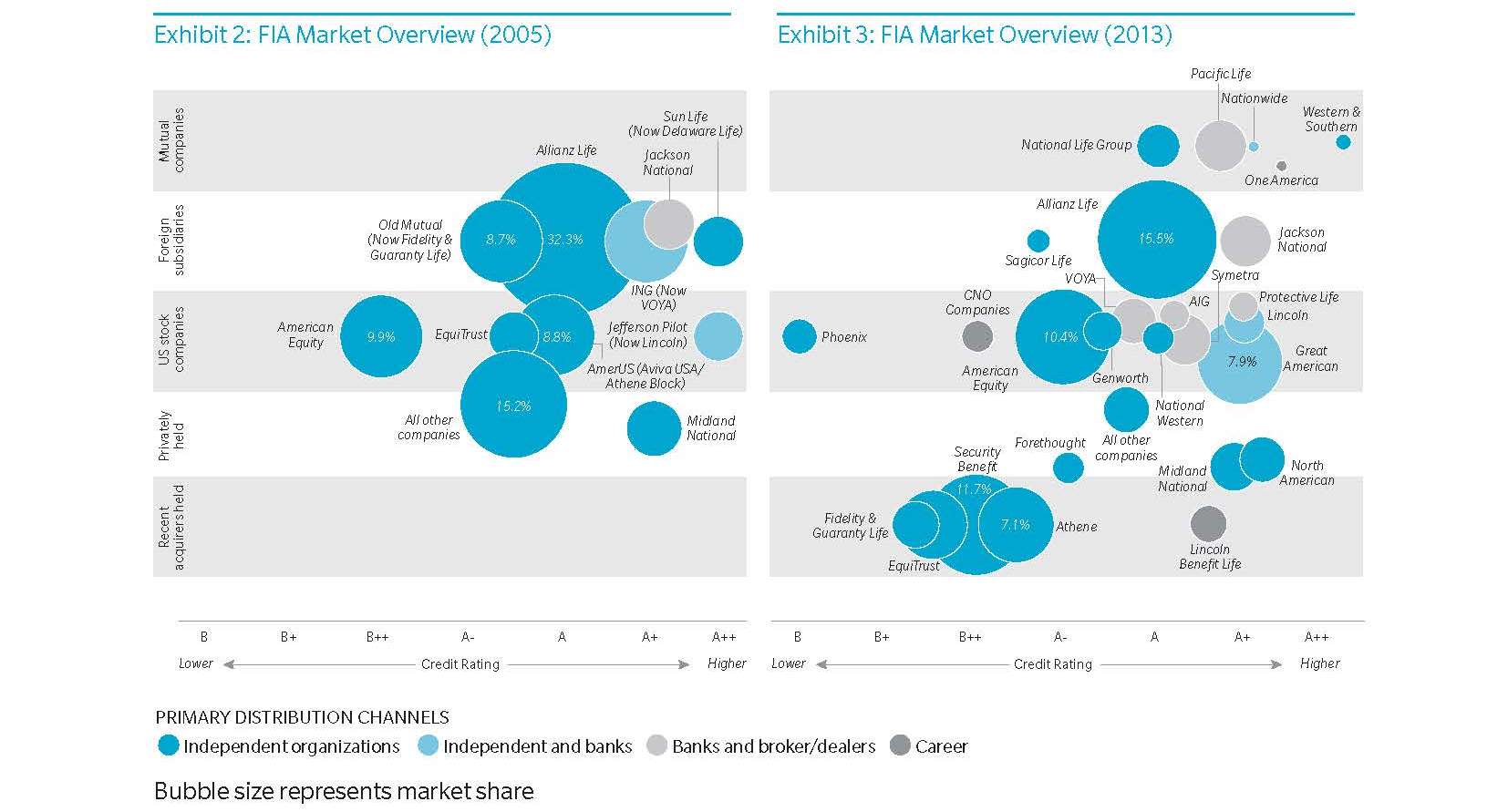

Significant shifts have taken place in the FIA market over the last decade. To show the magnitude of these changes, Exhibit 2 and Exhibit 3 below illustrate the make-up of the market in each of 2005 and 2013 using four key criteria:

- Company credit rating

- Ownership structure

- Market share

- Primary distribution channel

In these graphs, each bubble represents a carrier and its market share. The horizontal axis reflects credit rating. On the vertical axis, the chart is divided in segments representing ownership structures; from top to bottom: mutuals, foreign subs, US stock companies, privately held entities and carriers held by recent acquirers. Colors represent the dominant distribution channel or combination of dominant channels for a given carrier. For example, in 2005 Allianz Life belonged to the foreign sub category, had an issuer financial strength rating broadly equivalent to A (A.M. Best), had the largest market share (32.3%) and mostly distributed in the independent channel.

A side-by-side comparison of the graphs unveils the following trends:

In 2005, the vast majority of FIA sales came from foreign subsidiaries such as Allianz Life, ING, Old Mutual and Sun Life. This trend was magnified when Aviva PLC acquired AmerUS in 2006. In 2013, the only significant foreign

subs that remain are Allianz Life and Jackson National. Solvency II requirements and new Canadian regulatory requirements have made FIAs less attractive to the parent companies of foreign subs, contributing to divestitures and strategic realignments.

- RECENT ACQUIRERS GAINING GROUND

As illustrated previously, a number of recent acquirers have gained a solid market foothold through acquisitions. Many recent acquirers view their asset management and structuring capabilities as a way to generate value from existing blocks. In many cases these carriers have continued to issue new business via competitive products, resulting in increased assets under management and market share.

- EXPANSION IN BANKS AND BROKER/DEALERS

In 2005, sales through independent distribution (represented in blue in Exhibit 2 and Exhibit 3) accounted for approximately 90% of FIA sales. In 2013, approximately 25% of FIA sales came from outside of the independent channel. Most of this change is explained by the growth and success of new entrants with a proven track record in these alternative channels.

- BROADER CARRIER BASE

The FIA market was considered by many industry participants as a “niche” market in 2005. Today, this perspective is largely reversed and the universe of participants is much broader.

WHAT’S NEXT?

Following this period of exciting change and growth, here are ten emerging developments to watch for in 2014 and beyond:

1. M&A ACTIVITY IS LIKELY TO CONTINUE

With a growing number of players, competition is increasing and there exists a wide range of views on the valuation and attractiveness of the business. This and other factors, such as limited capital available to certain carriers, will likely fuel additional M&A activity.

2.THE MARKET IS WELL POSITIONED FOR A POTENTIAL RISE IN RATES

The FIA market is well positioned for rising rates relative to the traditional fixed annuity market. First, most FIA carriers’ inforce blocks are composed of recent sales and thus have surrender charge protection that reduces disintermediation risk. Secondly, approximately half of inforce FIAs feature a market value adjustment (“MVA”). Although many MVA features had mixed effectiveness when corporate yields spiked in late 2008-early 2009, MVA formulas were subsequently improved for new business. In addition, most carriers with growing GLWB blocks generally stand to benefit from higher reinvestment yields. Finally, rising rates would be expected to positively impact sales and reduce pressure on new business profitability.

3. FURTHER EXPANSION IN BANKS AND BROKER/DEALERS IS LIKELY

As long as the yield curve remains steep, significant growth in banks and broker dealer distribution will likely continue. This is being accomplished with low commission and short surrender charge “no frills” designs with competitive indexing features. In the long run, sales in this channel will benefit from inforce bank channel contracts rolling into new contracts, much like in the VA market.

4. ADDITIONAL CARRIERS WILL OFFER VA/FIA HYBRIDS

Carriers such as AXA (2010), MetLife (2013), CUNA Mutual (2013) and Allianz Life (2013) have launched VA/FIA hybrids. These products do not offer living benefits, and the rationale for introducing them varies. VA carriers might view these designs as a new and innovative way to attract VA assets without offering rich guaranteed living benefits. Others may see hybrids as a natural way to fill the “spectrum” of products available, or as a way to expand in new distribution channels. Finally, hybrids can be designed in such a way as to balance the risk profile of existing VA blocks, which can motivate VA carriers to enter the space for risk mitigation purposes.

5. SEVERAL REDOMESTICATIONS WILL TAKE PLACE

Several carriers have recently announced their intention to redomicile. Carriers relocating to Iowa include Fidelity and Guaranty Life (announced November 2013) and Symetra (announced January 2014). Athene also decided to locate its headquarters in Des Moines following the Aviva transaction. Going against this trend is EquiTrust, who is relocating from Iowa to Illinois (announced January 2014). Key factors motivating these decisions include the regulatory environment, operating costs and human resources. The scale of recent activity certainly invites other carriers to consider their options.

6. STATUTORY RESERVING WILL CONTINUE TO BE A KEY ISSUE

With the sharp decline in interest rates and statutory valuation rates, the conservative AG 33 framework is causing significant reserve strain for many carriers offering GLWBs. A number of companies obtained permissions from their regulator to apply less conservative reserve approaches on their inforce block such as AG 43 or modifications to AG 33. Meanwhile, the American Academy of Actuaries Reserve Working Group (“ARWG”) is working on the VM-22 reserving framework for fixed annuities. The industry is closely following these developments and is generally eager to adopt principle-based approaches on new business.

7. OPERATIONAL EXCELLENCE WILL BECOME MORE IMPORTANT

Third party providers have accelerated the product release cycle and helped many carriers reduce costs. One such third party provider issued $9 billion of FIAs in 2013. As the FIA market matures, operating costs and service to consumers and distributors will become more important differentiators.

8. CARRIERS WILL REFINE THEIR VIEW ON POLICYHOLDER BEHAVIOR AS EXPERIENCE EMERGES

Significant inforce blocks are starting to exit the surrender charge period, which will give FIA carriers a wealth of data on surrender behavior. GLWB utilization experience is still emerging, and several more years of experience are needed to observe behavior outside the surrender charge when a GLWB is present. Due to relatively limited industry data, there exists a wide range of GLWB surrender and utilization assumptions. Going forward, a growing number of FIA carriers will apply advanced analytical techniques such as predictive modeling to gain further insight into policyholder behavior for application in assumption setting and customer retention.

9. ECONOMIC AND MARKET FORCES MIGHT INCENTIVIZE GREATER INVESTMENT RISK

In a post-crisis environment with stronger corporate balance sheets and lower interest rates, certain FIA carriers compensated declining yields by seeking additional liquidity and credit risk premium. Growing sales volumes from recent acquirers and the rebalancing of asset portfolios from acquired blocks have created significant investment activity.

10. CARRIERS WILL STRENGTHEN THE RISK MANAGEMENT OF RIDERS

In contrast to their VA counterparts, FIA GLWB riders benefit from stable statutory and US GAAP accounting. Because of this and the “fixed income/book value lenses” of many FIA carriers, many companies primarily view GLWBs as a source of insurance risk that is consequently left mostly unhedged. However, GLWB riders impact both the duration and convexity of the insurance liability, and its sensitivity to index returns. Additionally, GLWBs can make FIA statutory reserves insensitive to changes in the index, which in turn can cause important statutory accounting volatility as the hedge crediting P&L emerges. Many FIA carriers will become more deliberate about how they embed GLWBs in their ALM, how they approach hedging decisions and how they manage statutory accounting volatility.

ABOUT THE AUTHOR

Guillaume Briere-Giroux, FSA, MAAA, CFA is Principal and Hartford Office Leader of the Actuarial Practice of Oliver Wyman. He has worked with most top 15 FIA writers on product development, pricing, financial reporting, risk management, financial modeling and mergers and acquisitions. Before working as an actuarial consultant, Guillaume was a corporate risk director at Allianz Life.