A Woman’s Retirement Reality

Unfortunately, what you are about to read happens far too often, and as a women, you owe it to yourself, to invest a few minutes of your time, and learn what it is you can do, to make sure that this all too typical story about to unfold, -doesn’t happen to you.

This piece is based in part on the Policy Brief: Personal Finance, Lifetime Income for Women: A Financial Economist’s Perspective. The upside here is that you don’t have to end up like the women in our story, but you may, if you don’t force yourself, and/ or your husband/, your partner, or your significant other, to make better decisions. You are about to come face to face with the economic realities many women face in their retirement years, or at least, -what is supposed to be, “their retirement years”. As you are already well aware, women and men are different -they make different decisions for different reasons about money. But women, outliving their husbands, usually end up alone to face the world without ample retirement savings. Women on a regular basis are forced to endure the effects of bad financial decisions made years ago, and much of it is preventable. Continue reading and you will learn that there is something can be done to secure your future …or not. It is up to you.

Note* This is based on the Policy Brief: Personal Finance, Lifetime Income for Women: A Financial Economist’s Perspective, David F. Babbel

Fellow, Wharton Financial Institutions Center

Professor of Insurance and Finance

The Wharton School, University of Pennsylvania

and Senior Advisor to CRA International.

The quotes in blue and/or red stem directly from the policy brief , the commentary in black is provided by Steven S. Delaney, President of American Annuity Advocates.

Her First Job at 66

Last December, I was attending a large sporting event in Philadelphia and sat next to an engaging couple. The woman had never worked outside the home, having been occupied with rearing eight children—a “his, hers and ours” type of situation. Her husband had been educated at one of America’s finest universities, had completed a very successful career, and then retired three years earlier from a well-paying profession. When the man and woman learned that I was a finance and insurance professor, the conversation turned quickly to financial matters.

They informed me that the defined benefit pension plan of the firm from which the man had retired had been discontinued and re-opened as a defined contribution 401(k) retirement savings plan.

Under such plans, the investment risk is transferred from the employer and government entirely to the employees and retirees. This meant that instead of receiving a comfortable monthly income throughout the rest of their retirement, they received a lump sum of cash that they could elect to place in a menu of mutual funds, or withdraw all the cash, and use it however they desired. The man seemed to be quite concerned about their financial future, and suffered from several degenerative ailments. We discussed the treatment options and prognosis, which were not hopeful.

When the man stepped out to get a cheeseburger, I learned the rest of the story from his wife. Upon retirement, her husband had opted for the rather generous cash settlement and had been persuaded by their nephew to invest it—virtually all of it —in a promising new venture managed by the nephew. I knew the rest of the story, as I suppose you do; only the details I lacked. Within two years, the promising venture failed and the couple’s entire sizable retirement savings were gone. They had to mortgage their home again and due to the husband’s more advanced age, the woman had to find employment.

At sixty-six years of age, she was studying to pass a real estate exam and begin her first job, just as the housing market crashed, already saturated with real estate agents, many sellers and few buyers. Now, instead of enjoying a cozy retirement, she was resigned to spending at least the next 15 years to pay their debts and support them partway through retirement. She was hoping to work until 81, and figured (due to his poor health) that she would manage alone most of those years, but hoped to get by financially until she reached her life expectancy of 88. (She hadn’t really given much thought to the fact that half of all women live longer than their life expectancy, many substantially longer.) I have heard stories like this everywhere, from relatives and colleagues to Charles Dickens novels.1 It was untimely to tell them that if they had taken their substantial lump sum cash distribution and invested most of it in a joint and survivor lifetime income annuity, they both would be receiving a comfortable income throughout their remaining lives.

A Financial Storm

Five forces are converging upon Americans today in what some have called the Perfect Storm and it is about to engulf us from all sides. The situation is particularly precarious for women, as I will demonstrate shortly, and there isn’t anything we can do to stop these converging forces. The best we can do is to organize our own finances in such a way that we can provide for ourselves and our families.

Currently American women face:

(1) decreasing rates of return on their Social Security contributions (averaging 1.8% per year for single women—Source: Social Security Administration);

(2) the accelerating demise of defined benefit pensions (150,000 pension plans, which would have provided lifetime income security, have been discontinued since 1983, leaving less than 25,000 plans today, many of which plan to close within two years—Sources: Pension Benefit Guaranty Corporation,

Employee Benefits Research Institute, Mercer);

(3) the transition of the baby boom generation into retirement (the first boomers reached retirement eligibility in 2006 and will continue to enter the retirement ranks over the next 20 years, creating a huge cash drain on our Social Security system—Source: Social Security Administration);

(4) longer expected lifetimes (65-year-old women have added another 4 years to their life expectancy since the 1960’s—Source: US Census Bureau; over the past 160 years, women in the most developed countries have steadily added another year to their life expectancy for each four years that

pass)—Source: Dr. James Vaupel, Director of the Max Planck Institute for Demographic Research); and

(5) the much smaller post-baby boom generations who are being asked to support boomers’ unfunded benefits along with their own healthcare and retirement needs (and, owing to their greater life expectancy, women’s benefits will be much costlier to fund than men’s, all other things equal—

Source: US Census Bureau).

Three Approaches

Leaving the failed venture saga aside for now, and dismissing another dubious approach of attempting to retire by living from one’s savings accounts, there are three other broad approaches that individuals generally take when deploying their accumulated assets as they enter their retirement years.

Each approach has variations, and we will omit the details here.

Approach #1:

Annuitize a substantial portion of their accumulated wealth.

Approach #2:

Invest primarily in fixed income instruments such as CDs, bonds, money market funds, etc.

Approach #3:

Invest primarily in stocks, bonds, and mutual funds.

If the first approach is followed, you can secure your desired pattern of income throughout the remainder of your lifetime, however long it may last, by investing in an appropriate mix of annuities. You should also put some money away for emergencies, and then if you have money remaining, you may invest some in stocks, bonds and other investments, and give the rest away. Under the first approach, it makes little difference from a financial point of view when you give the money away, as the amount given away has the same present value, and the money is not needed to fund you throughout your remaining lifetime.2

Your heirs and the amounts they will receive no longer get reduced if your lifespan increases.

The second approach has two variations. Under the first variation, you can create the same desired pattern of income throughout the remainder of your lifetime (with the help of a skillful investment advisor). However, to achieve the same income security as you would have under the annuitization approach, it will cost you 25% to 40% more, as will be explained later. There remains some risk that the income will expire before you do, depending on how interest rates evolve during that time. Again, you will need to set aside some funds for emergencies and may wish to give some money away while still alive, so you will need even more than the 25% to 40% extra, or else you will increase your chances of running out of money before you run out of life. (You may take grim solace that if the former happens, the latter will not lag too far behind….) What money may be left for your heirs will depend largely on how long you live.

They become the residual claimants and absorb the financial risk. The longer they may assist you with care, the less they will ultimately receive. They even may need to support you financial y.

The other variation on the second approach, with similar risk of failure, goes like this. Rather than spending 25% to 40% more, you could invest in an expertly designed portfolio of fixed income instruments an amount of money equivalent to what would have been needed under the annuitization approach, but consume 25% to 40% less each month. Again, if you run into an emergency or give away some of your money while still alive, or if interest rates evolve adversely during your remaining lifetime, your chances of failure will increase. Your heirs again become residual claimants, absorbing the financial risks of your strategy.

The third approach is to roll the dice, effectively, by placing all of your wealth in stocks, bonds, and mutual funds, including the increasingly popular “life cycle funds.” This approach attracts some people because it allows the most flexibility in the use of your funds—the most liquidity—and it has the potential for the greatest returns—or the worst. But it comes at a cost of providing the least financial security. The temptation is always there for you or your spendthrift spouse to spend extra, or to get hit up by a grandchild that needs a new boat, or sought by others that know that your money is sitting there and available. Alternatively, if the stock or bond markets go against you, it is likely that your money won’t last through retirement, and you will be relegated to living on Social Security, the largesse of relatives, or charity. To be able to follow the third approach, yet incur risk no greater than the second approach, will require a much higher investment at the outset. (There is no possibility of incurring the minimal level of risk associated with the first approach if the retiree places all of her money in stocks, bonds, or mutual funds.) You might end up with greater consumption than you would under the first or second approach, but you could wind up in very dire straits.

The third approach has had some appeal based on enticing, but flawed logic, as follows: Because females, on average, live longer than males, they need to accumulate more wealth to finance their retirement needs. (So far, so good, but now the logic descends down a slippery slope.) Traditionally, financial advisors have said that women would need to take more financial risk in order to obtain the higher returns necessary to produce that greater wealth. “Stocks for the long run” has been the conventional, albeit parroted wisdom. But recent, rigorous studies have called into question that aphorism.3

These studies show that, contrary to conventional wisdom, when there is uncertainty about the long term expected returns in stocks (which there certainly is!), longer investment horizons, such as those for retiring individuals, imply substantially lower allocations to stocks than those usually suggested.

These studies also show that most investors, even professional money managers, substantially underperform the stock indices upon which many advisors base their recommendations for taking greater financial risk.4

Bad Press?

First we need to clarify something. Annuities have gotten a bad rap in the popular press over the past several years, but most of the attacks, warranted or not (and according to our research, generally not warranted), have been focused on deferred annuities, whether fixed, equity-linked, or variable. Such deferred annuities are far different from the lifetime income annuities discussed under Approach #1, although most feature an option to convert to a lifetime annuity at the end of the deferral period, or earlier.

I have reviewed over 70 academic studies that have appeared since 1999, analyzing lifetime income annuities vs. other alternatives, and coauthored another major study. (Most of these are included in the reference section to this paper, as well as a handful of earlier academic studies, each marked with an asterisk.) The consensus of the literature from professional economists is that lifetime income annuities should definitely play a substantial role in the retirement arrangements of most people. How great a role depends on a number of factors, but it is fair to say that for most people, lifetime income annuities should comprise from 40% to 80% of their retirement assets under current pricing. Generally speaking, if a person has no bequest motive, or is averse to high risk, the portion of wealth allocated to annuities should be at the higher end of this range.

Lifetime income annuities may not be the perfect financial instrument for retirement, but when compared under the rigorous analytical apparatus of economic science to other available choices for retirement income, where risks and returns are carefully balanced, they dominate anything else for most situations. When supplemented with fixed income investments and equities, it is the best way we have now to provide for retirement. There is no other way to do this without spending much more money, or incurring a whole lot more risk—coupled with some very good luck.

In this essay, I will highlight those factors that apply especially to women. It ends up that the annuitization choice is even more important to their economic well being than it is to the male population, because women will generally live several years longer, and most will do it alone for many years.

Risk Tolerance

There are more than a dozen recent studies which consistently show that males are more tolerant of risk than females.5 These studies were based variously on observed behavior (revealed preference), experiments, and surveys. Yao and Hanna (2005) summarize the key findings:

- Males will be less likely than females to annuitize their wealth at retirement, other things equal.

- Males are more likely than females to place their funds in risky investments.

- Married women, who generally outlive their husbands by about six years, may have to live with the consequences of these choices unless they participate in the financial decision-making.6

- In addition to gender, other factors are related to an individual’s risk tolerance, including wealth, income, financial sophistication, knowledge, race, and years until retirement.

- The spectrum of risk tolerance reveals that after taking all of the other demographic/economic factors into account, unmarried males were the most likely to take high financial risk, followed by married males, and then by unmarried females. Married females were the least likely to take high risk.

- These risk tolerant levels are significantly different. Unmarried males were 1.4 times as likely as married males to take on high financial risk, and twice as likely as unmarried females, similarly situated, to take on such high financial risk. Married males were 1.7 times as likely as otherwise similar married females to take on high financial risk.

- Women are more likely than men to invest in risk-free securities, such as bank CDs and US Treasury securities, suggesting that women are less risk tolerant than men. (Embrey and Fox, 1997)

- Single women have a lower propensity to invest in stocks and a higher propensity to invest in bonds than married females, married males, and single males. (Christiansen et al, 2006)

- Men are more likely to allocate their assets to “mostly stocks,” which indicates an appetite for more financial risk. (Sundén and Surette, 1998)

Findings from New York Life’s Consumer Questionnaire

In March of 2006, New York Life Insurance Company conducted a consumer questionnaire through National Research in Washington, D.C. The focus group of the survey was on people with greater than $100,000 in accumulated financial assets. Of the survey respondents, 59% were college graduates or higher, and 48% already owned annuities of some sort. Several of the survey findings are particularly relevant to women.

- Only 54% of women expressed confidence that they would be able to maintain their lifestyle after their husband’s death.

- Women were 69% more likely than men to prefer fixed annuities with higher lifetime income guarantees over variable annuities with lower income guarantees, but with the potential to receive even higher income if the equity markets performed well. Men had the opposite preferences.

- Men were 40% less likely than women to work with a professional financial advisor.

- The survey reported that 67% of the men said they were comfortable with financial risk, but only 30% of women were comfortable with it.

- Fortunately, while only 38% of the women are primarily responsible for making household financial and investment decisions, the majority of women are now making them together with another person. This should enable women to reduce the chances that financial decisions are made to their detriment, and that appropriate annuitization choices are made to cover their income needs during their retirement years.

Taken together, the academic studies and survey findings suggest that women should be especial y careful to secure a lifetime income. The first broad approach mentioned above—annuitization—remains the only sure way to achieve it at a reasonable price. Other alternatives might work, or they might not.

Other Findings

There are other research findings that underscore the importance for women to take financially prudent steps.

- Older women are 50% more likely than older men to live in poverty. (Bureau of Labor Statistics)

- The poverty rate for people above age 75 is 33% higher than that of people age 65-74.

(Bureau of Labor Statistics)

- Approximately 44% of the elderly will ultimately require nursing home care.

(Spillman and Lubitz, 2002)

- The average annual cost of institutional care in 2000 was $70,080 for a private room and $61,685 for a semi-private room. (Spillman and Lubitz, 2002) By 2007, the average cost had risen by an additional $5,000. (MetLife)

- Roughly 75% of the residents of nursing homes are women. (Spillman and Lubitz, 2002)

- The majority of the residents in nursing homes are widowed, functionally dependent females. (Spillman and Lubitz, 2002)

- About 72% of the residents required help in managing money. (Spillman and Lubitz, 2002)

- Women generally have much longer stays than men in nursing homes. (Spillman and Lubitz, 2002). One reason for this is that women are generally younger than their husbands and provide compassionate home care for them in their declining years, delaying the time before which they need to be cared for in a nursing home. Less than 10% of women, on the other hand, have a companion by the time their health declines, and so they seek institutional care at an earlier stage of their declining health. Ironically, in many cases the couple’s financial reserves have already been expended on the husband’s care, leaving little for the woman. (See CHART 1)

- The increasing share of retirees forgoing annuities raises the prospect of retired workers depleting their assets so that they have no resources beyond Social Security and higher poverty rates among widows. If annuities were one of the options under retirement savings plans, it could help avoid this outcome. (Johnson, Uccello and Goldwyn, 2003)

Why Do Lifetime Income Annuities Yield So Much?

Lifetime income annuities typically yield substantially more than what you can earn on CDs, bonds, or money market funds. In fact, for people who invest in annuities several years into retirement, they yield even more than you could expect to earn on risky common stock. Why?

Consider a 23-year7 home mortgage of $100,000 that charges 6% interest per year, compounded monthly. Instead of making monthly payments that total $5,000 per year, a traditional 5% mortgage sets your payments higher so that at the end of the mortgage loan, you have paid not only the loan interest, but also the entire principal. In this example, your payments would total $7,324.90 per year, and the additional payments beyond interest would go toward amortizing the principal.

Annuities work very similarly except that you are on the receiving end. Each monthly payment you receive contains interest on your investment and a return of a portion of the principal. That is why the payments you receive surpass the going rate of interest by a good margin.

So, you might ask, “Why not invest my retirement savings in home mortgages instead of annuities? If at 65 I expect to live an additional 23 years, why not simply lend my money to people buying houses?” There are three reasons why this is unwise.

(1) The borrower might default. (“True,” you counter, “but not if I invest in government-sponsored agency mortgages.” However, for this “guarantee” or mortgage pooling, the agency extracts a goodly portion of the interest you would otherwise earn. Moreover, most agency mortgages e.g., (Fannie Mae, Freddie Mac), have carried no explicit government guarantee in the past. However, this will change for some in light of the current sub-prime lending crisis and government bailout.

(2) The borrower will probably prepay the loan if interest rates decline during the amortization period, and you will have to reinvest what you receive in lower yielding assets. This will decrease your monthly earnings. A 30-year mortgage may last anywhere from 1 to 30 years (and typically less than 12 years) before the borrower moves, repays the loan, defaults, dies, or refinances the mortgage. Unlike an annuity, the ultimate lifetime of a mortgage investment is completely unrelated to your own lifetime.

(3) You might live longer than 23 years—after all, half of women do—in which case there will be no interest or principal remaining on the mortgage for you to receive. With lifetime income annuities, the funds are pooled together by an insurer among all annuitants so that those who live less than the 23 years life expectancy will help to fund those who live beyond it. In this way, principal and interest never run out as long as you may live. Lifetime income annuities are the only investment that will protect you in this way.8

Annuity Pricing for Women

One area where people occasionally get confused is the pricing of annuities for women. When a woman purchases a lifetime income annuity for herself, the monthly income flow is somewhat below that which would be received if a man of similar age bought the same type of annuity for himself.

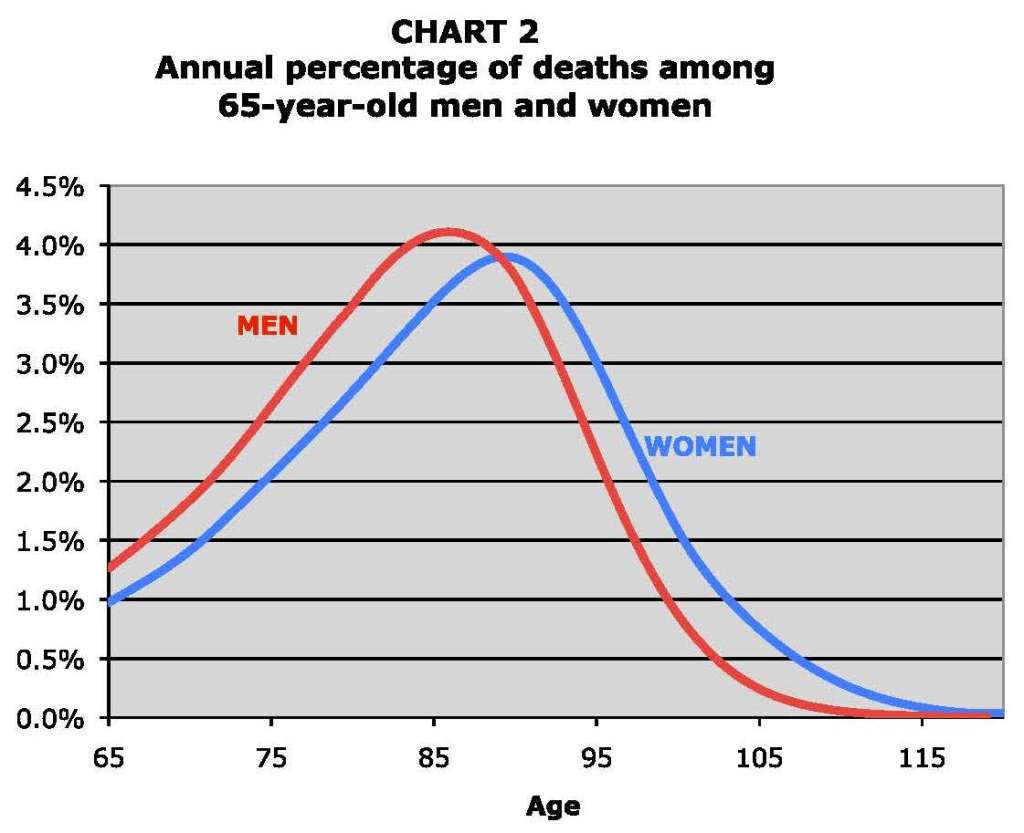

However, women tend to live longer than men and receive, on average, 42 extra monthly payments than men. (See CHART 2) Someone has to pay for those extra 42 payments, and except in Montana, where annuities are unisex and men subsidize the women, the women must pay for what they receive. When you look at what women receive relative to what they pay for a lifetime income annuity, adjusted for the timing of payments and the interest earned, it actually works out that women pay less than men for equivalent annuities.9 But when an annuity is purchased by a man and a woman on a joint and survivor basis, these questions go away, because they are priced to reflect the last survivor.

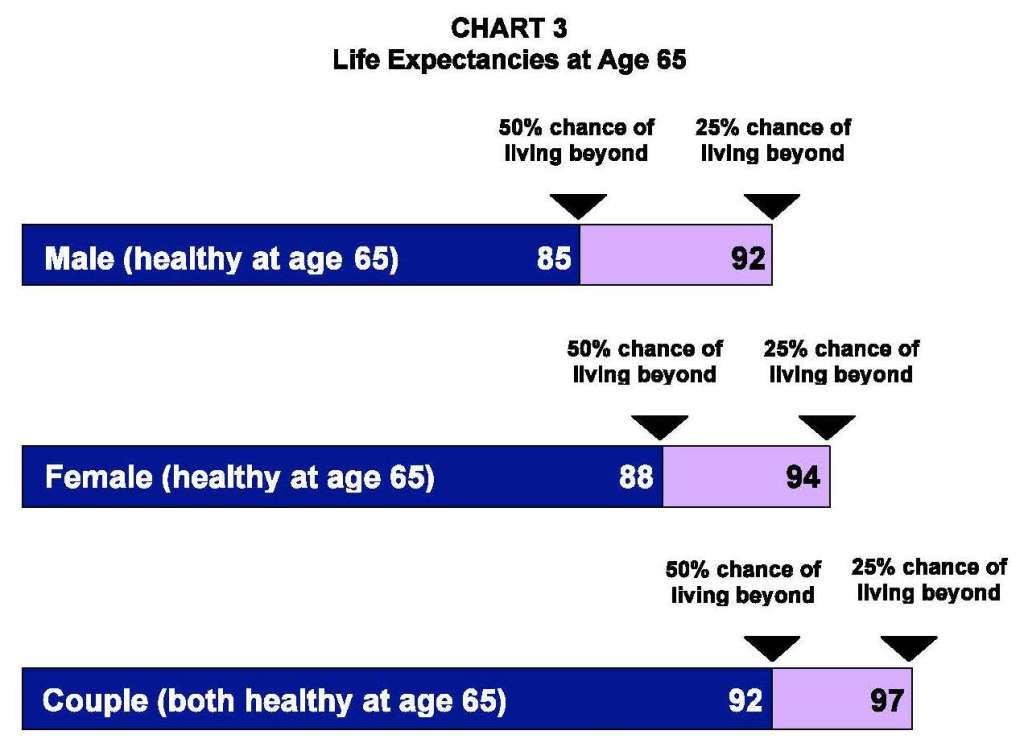

(See CHART 3)

Another area where people get confused is on the mortality probabilities that are factored into the annuity purchase prices. Companies base their prices on the population of people who actually purchase annuities. Therefore, if a company has a relatively healthier clientele than the population at large, they will likely be making monthly payments for a longer time to these clients and will have to factor this into the prices.10

When we studied the prices that insurers currently charge for their lifetime income annuities, we found that the price markups were very low. As recently as one decade ago, the price markups— “loads” in insurance parlance, which are margins included in prices to cover sales and administrative expenses,

as well as provide a return on capital to the insurer—ranged from 6% to 10%.11 But one decade later, by March of 2006, we found that the markups on lifetime income annuities had decreased to the 3% to 5% range, and in some cases were approaching zero.12 These one-time loads compare favorably to the 5% to 8% front-end or back-end loads charged by many mutual funds, on top of their recurring fund management charges that generally amount to over 1% of assets account value per year. Such costs mount up over time.13 Moreover, it is common for investors to switch from one fund to another after 3-4 years in search of better performance, and this behavior may generate new front-end or back-end loads with each switch.14 The combination of these factors means that investors typically perform far worse than the market indices would suggest, generating only about half as much income over 20 years as the market. There is some recent evidence that people between 65 and 95 years of age have an additional hurdle to overcome, as their average returns have been about 2-3% less per year than those achieved by younger investors, even after adjusting for risk differences.15

Not withstanding the favorable annuity pricing conditions for consumers at this time, many simply do not want to buy annuities. A fascinating study suggests that this reluctance to purchase annuities may remain, even if annuities are given away at prices below cost!

A Military Experiment

The aforementioned study was published in the American Economic Review.16 It examined the financial decisions made by 11,000 military officers and 55,000 enlisted men and women during the early 1990’s, when the military engaged in downsizing after the collapse of the Soviet Union. Military personnel were offered incentives to retire early, including the choice of a lump sum payment or an annuity that stretched over several years. The annuities featured exorbitant, embedded, guaranteed annual rates of interest ranging from 17.5% to 19.8%, which compared quite favorably to the 7% interest rates that were prevailing at that time in the capital markets. Pamphlets, brochures, and counselors were provided to demonstrate that the lump sum payment alternative was worth only roughly half as much as the present value of the annuity.

Nonetheless, a majority of the officers took the lump sum payment alternative, and over 90 percent of the enlisted personnel did so! The study investigated the effect of several demographic factors on the choices and found that those who were better educated, those who were older, those who scored in the top two groups on the intelligence tests given to military enlisted personnel, and those who were women (some of whom also fell into one or more of those other categories) were significantly more likely to choose the annuity alternative, other things equal. But what was shocking to me was that most of the armed forces personnel chose to take the lump sum option, even though the annuity alternative was providing a riskless return that was approximately twice as high as the risky expected return from the stock market. Just about anybody in the financial markets would have selected the annuity alternative, were it available to them. This behavior demonstrated that the reason for relatively low levels of voluntary annuitization which we saw in the past cannot be ascribed solely to annuity prices that were perceived to be high, because in fact, the annuities were being given away far below cost! Therefore, we must turn to other factors that may have impeded annuity purchases in the past.

Flexibility

In the past, some women have been reluctant to purchase lifetime income annuities because of their perceived inflexibility (where “their” refers to the annuities and not the women). However, over the past few years, a number of features have been added that allow enough flexibility to satisfy most needs.

Here is just a sampling of the product features that are now available. Not all insurance companies include these features, so you will have to do some investigating.

(1) Inflation adjustments. In today’s products, you can have level income throughout life, or you can opt to have payments increase by some set amount each year, such as 1-6%, or even decrease by similar amounts. The option you select for payment adjustments over time will affect the size of the initial payments. If you opt for increasing payments over time, the initial monthly payment will be lower; if you opt for decreasing payments over time, the initial payment will be higher. Alternatively, products are available that make annual payment adjustments based on the inflation rate over the previous year.17 An alternative to formulaic payment adjustments within the contract is to supplement the level income annuity with a deferred annuity, which will accumulate interest tax-deferred. The deferred annuity can be annuitized later and supplement the monthly income you are receiving from your base annuity. If annuitizing the deferred annuity prematurely would incur a penalty, you can opt to take penalty-free withdrawals from the deferred annuity until the surrender period is over, and then annuitize the remainder at that point. If inflation subsides and you end up not needing the supplemental income, you can bequeath the annuity to heirs or cash it in and transfer the money to them directly.

(2) Varying needs. Another feature allows you to have your income bump up or down at some future date (of your choosing) by a preset amount (of your choosing) by as much as 400%. For example, you may feel a need to have your monthly income increase at age 85 by 200% in order to be prepared to pay for institutional care.

(3) Emergency needs. Some products also allow you to take withdrawals for emergency purposes, such as uncovered medical bills. These products allow the annuitant to withdraw sums from her remaining annuity value to cover the emergency. Some products allow you to withdraw 6 months worth of payments twice or more often to cover such contingencies.

(4) Interest rate protection. Some people delay their purchase of annuities in hopes that the embedded annuity yields will rise even higher. (The problem is that the interest rates and mortality tables may go against you while you are waiting.) However, there are products available today that allow you to lock in today’s annuity yields, and have a second look in five years. If interest rates have gone up by more than 2%, you will get a roughly 20% upward adjustment in your monthly payments. If interest rates have stayed steady or declined, your payments will not be reduced.

(5) Payment over time. Some people prefer to pay for annuities over time rather than in a single lump sum. There are two ways to do this. One is to purchase smaller annuities over a period of several years, until you have accumulated the desired total. Another way is to enter into a contract that has periodic payments embedded into its structure. Either way, additional purchases/payment amounts and their timing are at your convenience, and your purchases will reflect different pricing environments over time.

(6) Refund of investment. If you buy a traditional lifetime income annuity but die soon thereafter, your investment would have no additional value to your heirs. However, products are available today that protect your heirs so that they will receive the difference between what you paid and what you receive prior to death if death occurs within the contract’s first 5-20 years (and you select the length of that protection period).

(7) Period certain income. Traditional lifetime income annuities make monthly payments for as long as you live. If that period is very short, some people are unwilling to commit to the investment.

However, annuities today allow you to elect a minimum “period certain”—say, 5 or 10 or 20 years under which payments will be made to you or your heirs, while maintaining lifetime income guarantees.

Some insurers even allow you to withdraw the present value of the unused portion of that period certain promised income stream at any time, while leaving in place the payment stream that will continue after your age surpasses the period certain.

(8) Death benefits. Products are available today that will pay a death benefit regardless of when you die. Alternatively, you may receive similar benefits by combining a traditional annuity with a life insurance policy.

To be sure, each of these features has an effect on the income stream you will receive under your lifetime income annuity. Some features have a negligible impact on that income stream, while others will require you to trade a lower monthly income for a desired feature. The choice is yours, and with the flexibility of today’s annuities, you will want to consider the options carefully to ensure that your needs are best addressed.

I note here in passing that annuities have limited protection from state insolvency guaranty programs against insurer insolvency. This is helpful to know for risk averse people, who might otherwise be reluctant to commit their funds to an insurer over the long period of retirement, absent some protection against default. Program limits currently range from $100,000 to $500,000, depending on your state of residency at the time of an insurer’s insolvency. Because a lifetime income annuity is a long-term contract, it is always most prudent to select from only the highest quality companies. The guaranty programs should be viewed only as a backstop, but the first line of defense is the quality of the annuity provider.

Conclusion

While this article reflects my sincerely held opinions, I am not alone. Leading economists from all over the world agree on the importance of lifetime income annuities and their central role in retirement planning. And today, with the elimination en masse of defined benefit pensions, the annuitization choice is even more important. Nonetheless, these lifetime income annuities are rarely included in the menu of options for investing 401(k) retirement savings during the accumulation phase before retirement, nor in the decumulation phase that begins at retirement.18 Such retirement options menus are much more likely to list a spate of mutual fund offerings that offer little or no security against the major risk of retirement: outliving your assets. Therefore, if you wish to obtain one of these investments to provide lifetime income for your retirement years, you may need to seek them out from life insurance companies. Happy hunting!