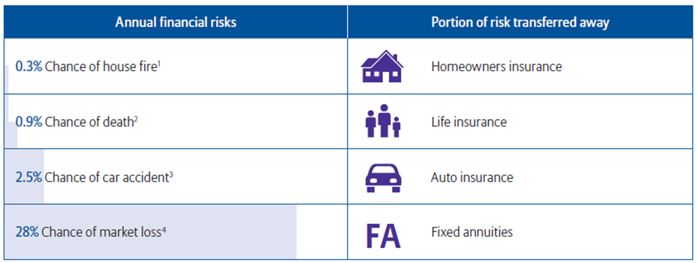

Protect/ Insure your retirement assets, just as you protect/ insure other assets

Since 2000, most investors have witnessed, and personally experienced, strong fluctuations in various financial markets. With more people looking at retirement prospects without the assistance of traditional retirement sources such as a defined pension plan, a much greater weight has been placed on their shoulders to save for their own future.

Insured solutions can help protect your retirement from risk.

The fact of the matter is that most people will take steps to insure their property. They will purchase homeowners insurance or car insurance to help protect against loss of value due to unfortunate circumstances, such as a fire or car accident. Life insurance is purchased to help reduce the risk of leaving loved ones with a financial burden, or with insufficient financial resources. Yet many may not consider how they can protect their retirement assets.

1Percentage is calculated from U.S. Fire Administration Fire Estimates, “Residential Building Estimates,” www.usfa.fema.gov/statistics/estimates/index.shtm and American Housing Survey for the United States: 2011. Accessed October 2013.

1Percentage is calculated from U.S. Fire Administration Fire Estimates, “Residential Building Estimates,” www.usfa.fema.gov/statistics/estimates/index.shtm and American Housing Survey for the United States: 2011. Accessed October 2013.

22001 CSO Table, www.actuary.org/life/sco_0702.asp. Accessed October 2013.

3Percentage is calculated from the U.S. Department of Transportation National Highway Traffic Safety Administration, “Highlights of 2011 Motor Vehicle Crashes,” Traffic Safety Facts, December 2012 and Fatality Analysis Reporting System (FARS) Encyclopedia 2011, www-fars.nhtsa.dot.gov/Main/index.aspx. Accessed October 2013.

4Percentage is based on number of years (14) the S&P 500® was down during the 50-year period between January 1, 1962 – December 31, 2011. Jeffrey A. Hirsch and Yale Hirsch, Stock Trader’s Almanac 2013, p. 155.

The data provided for the table came from sources believed to be reliable and the most recent available.

Product and feature availability may vary by state and broker/dealer.

Are you ready for retirement?

Now may be the time to consider protecting a portion of your retirement assets from market risk. This can help you achieve your retirement goals.

One potential solution is the purchase of a fixed annuity that offers protection of principal, minimum guarantees, and accumulation potential. Fixed annuities can help you meet your long-term financial goals by providing tax deferral, a death benefit, and a guaranteed stream of income at retirement, that you cannot outlive. You may also have the opportunity for increasing income with certain annuities, where an income rider is included, or by purchasing optional guaranteed income riders that are available for an additional charge. Income riders that provide increasing income can help reduce inflation risk, and may help you feel more confident about your retirement income.

Fixed annuities can help transfer multiple risks!

Fixed annuities that offer these benefits can provide the opportunity to reduce other retirement risks that you may face, such as:

- Longevity risk – The risk of outliving your retirement assets

- Inflation risk – The risk of inflation eroding your retirement income’s purchasing power

- Sequence of return risk – The risk of negative market returns

Surrender charges (early withdrawal penalties) may result in a loss of credited interest and a partial loss of principal (your premium).

Surrender charges (early withdrawal penalties) may result in a loss of credited interest and a partial loss of principal (your premium).

Any distributions are subject to ordinary income tax and, if taken prior to 59½, a 10% federal penalty tax may apply.

Guarantees are backed by the financial strength and claims-paying ability of the issuing carrier

Standard & Poor’s 500® Index (S&P 500®) is comprised of 500 stocks representing major U.S. industrial sectors. “Standard & Poor’s®,” “S&P 500,” “Standard & Poor’s 500,” and “500” are trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use by Allianz Life Insurance Company of North America.

-

Not FDIC insured ● May lose value ● No bank or credit union guarantee ● Not a deposit ● Not insured by any federal government agency or NCUA/NCUSIF