There are two halves to a retirement income strategy.

Make sure your financial strategy addresses both.

What happens after retirement can be just as important as what happens before!

If you’re like most Americans, you’re concerned about retirement. You may be working with a solid financial strategy to help ensure that you accumulate enough money. What may not be obvious, though, is that saving enough money to retire is only half the equation.

The first half – saving for retirement

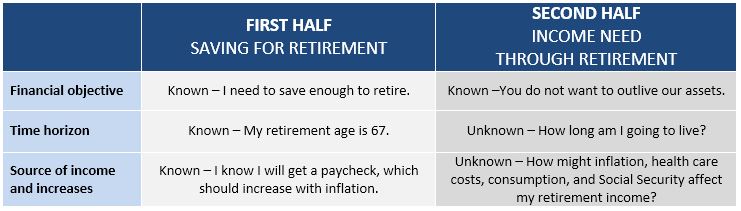

During the first half, you are still working. You have a known source of income, an idea when you want to retire, and you may be working with your financial professional to help you save enough. However, as the table below shows, there are even more unknowns once you retire.

Make sure you and your spouse aren’t just focusing on the first half.

After all, planning for the unknowns during retirement may be the most challenging part.

Product and feature availability may vary by state and broker/dealer.

The second half – income through retirement

When considering future circumstances and economic obstacles

When considering future circumstances and economic obstacles, it’s important to have a financial strategy for retirement income that is flexible. Although your financial objectives within retirement are known (ie: to not outlive assets), make no mistake that the unknowns can pose a real risk during retirement:

- Longevity – You have no idea how long you are going to live, so you have no idea how long your second half will last, as life expectancy is increasing.

- Inflation – If you’re standing still, you’re falling behind! Most expenses increase on an annual basis.

- Health care costs – Injuries or illnesses in the second half can be devastating.

- Consumption – For many retirees, consumption amounts don’t drop as much as they might think.

- Social Security – With the uncertain future of Social Security, it’s important to consider additional alternative financial strategies for retirement.

Life Insurance Companies offer annuities that can help you prepare for both halves of retirement. They offer tax deferral, principal protection, and accumulation potential, plus guaranteed lifetime income. You can choose the income option that may be the best for you when you elect to start receiving income: steady predictable income, or an increasing income opportunity.

After all, your annuity doesn’t have to stop working for you when you stop working. With a fixed-indexed annuity that has an income rider, it won’t. The income stream has the potential to keep up with, and possibly surpass, the rate of inflation.

1Income benefits may be issued as riders for an additional cost.

1Income benefits may be issued as riders for an additional cost.

The purchase of an annuity is an important financial decision. You should have a full discussion with your financial professional before making any decision.

Distributions are subject to ordinary income tax and, if taken prior to 59½, a 10% federal penalty tax may apply.

Guarantees are backed by the financial strength and claims-paying ability of the issuing company.

-

Not FDIC insured ● May lose value ● No bank or credit union guarantee ● Not a deposit ● Not insured by any federal government agency or NCUA/NCUSIF