Protect your retirement income from market volatility:

Understanding the impact, and timing, of your sequence of returns

How would another drop in the market affect your retirement assets?

With today’s longer life expectancies for women and men, you may have more years in retirement.

That’s the good news. However, the longer life expectancy may increase your risk of losing assets due to market volatility.

During the accumulation phase of retirement saving, the period before you start withdrawing money, usually ages 21 to 65, there may be enough time to weather volatile markets. Despite the ups and downs, over time, your assets can still grow appreciably.

Once you start withdrawing income, you’re much more vulnerable to market conditions.

During the distribution phase of retirement, experiencing market volatility – while simultaneously withdrawing assets for income to use in retirement, can have a huge impact. The sequence of returns risk, “experiencing negative years early or too often” can cause you to run out of money too early in your retirement or force you to withdrawal or spend less in retirement. That’s because, when you withdraw assets in retirement while the market is down, your losses on those assets are essentially “locked in.” Unlike the accumulation phase, when withdrawals are not taken, money you withdraw for income when the market is down no longer has the potential to increase if the market rises. As you rely on your retirement savings to meet your monthly or annual living expenses and you expose your assets to the ups and downs of the market, negative returns could cause you to run out of money more quickly than you anticipated.

The point is, experiencing negative years early or too often can diminish the total value of your remaining assets. Over time, your withdrawals combined with such losses can chip away at your assets and cause your money to run out more quickly than anticipated.

How much can your sequence of returns affect how long your money lasts?

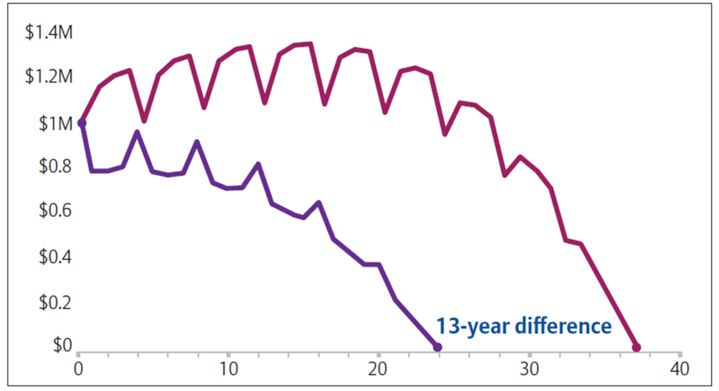

To demonstrate, let’s create a hypothetical example: Let’s say you’re retiring with a $1,000,000 nest egg, and plan to withdraw 5% per year ($50,000), adjusted 3.5% annually for inflation.

Assuming that today’s volatile market will continue (i.e., you’ll get positive returns as well as negative ones), let’s find out how long your nest egg could last under two scenarios – when the market is up as you start withdrawing income, and when the market is down when you begin.

The one uncertain variable is always going to be where the market is when you retire.

Could the difference be a few months – a few years – or even longer?

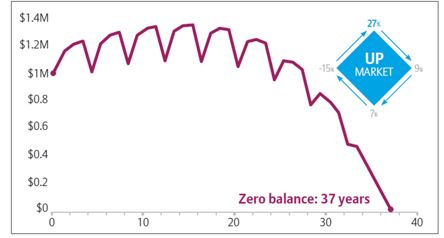

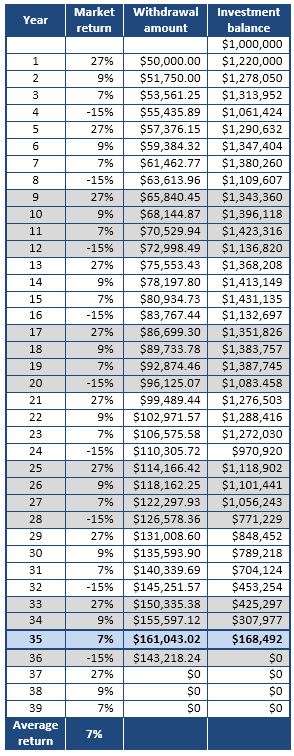

Scenario one: You start withdrawing your retirement income in an up market.

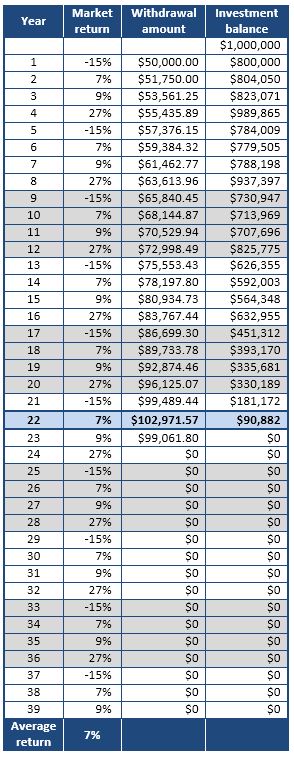

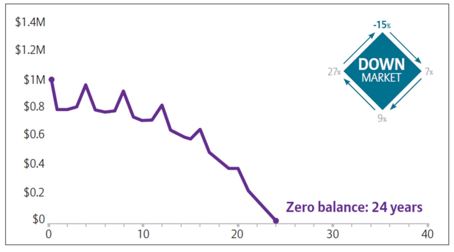

Scenario two: You start withdrawing your retirement income in an down market.

Your retirement income could have run out 13 years sooner.

By starting retirement in a down market, you may have lost over 10 years of income – and only because you have the same returns, but in a different order.

That, in a nutshell, is the risk that comes with your sequence of returns. And unfortunately, there’s no way to predict how much the market will be up or down when you start your retirement.

Starting in an up market versus starting in a down market

1Chart assumes a $1,000,000 starting balance with an annual $50,000 withdrawal (inflation-adjusted by 3.5% per year).

This is a hypothetical example and is not intended to project the performance of any specific investment or index. It is not possible to invest directly in an index. If this were an actual product, the returns may be reduced by certain fees and charges. Withdrawals are subject to ordinary income tax and, if taken prior to age 59½, a 10% federal penalty tax may apply.

An annuity can help manage sequence-of-return risk

During the critical pre-retirement years – generally 5-10 years before retirement – some of your assets could be repositioned, as you and your financial professional deem appropriate. The intent is to smooth out the impact of potential market volatility and to reduce the risk in sequence of returns.

One option is to convert a portion of your volatility-prone assets to a guaranteed product such as an annuity.1

The guaranteed lifetime income that annuities can provide can help in leveling the impact of an unfavorable sequence of returns.

Annuities, as part of your overall portfolio, can also help with your living expenses, as well as uncontrollable expenses such as medicine, insurance premiums, food, real estate taxes, and more.

Annuities can help you meet your long-term retirement goals by offering tax-deferred growth potential, a death benefit for beneficiaries during the accumulation phase, a guaranteed stream of income during retirement, and income benefits that are either built-in or available as an optional income rider at an have additional cost.

Annuity guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. You should carefully consider the features, benefits, limitations, risks, and fees that may be associated with an annuity. Ask your financial professional if an annuity is appropriate for you based on your financial situation and objectives.

1Please keep in mind that producers must be currently registered with a broker/dealer to provide advice about, or recommend the liquidation of funds held in securities products, including those within an IRA or other retirement plan, for the purchase of an annuity.