Understanding crediting methods

Fixed index annuities (FIAs) offer many important benefits. Understanding how they work can help you make better-informed decisions.

One benefit of a FIA is its potential to gain interest based on an external index. But how much indexed interest you receive will vary, depending on several factors.

One factor is the external index you select. Ask your financial professional about the index choices that are available with the FIA you’re considering.

Another factor is the interest-crediting method you choose for your FIA. The crediting method defines how changes in the index are measured. The crediting method also has components such as caps, spreads, and participation rates that may limit the amount of indexed interest you receive.

In the following pages, we’ll describe three common crediting methods and show how they work.

Components

Most FIAs have certain components that help determine how much indexed interest you can receive in a given year. Some annuities have only one component; other annuities may have several. The most common are:

Caps

Many FIA contracts set a “cap,” or a maximum interest rate the annuity can earn in a given period. If the index you select exceeds the cap, the cap is used to calculate your interest.

For example, if the annual cap in this hypothetical example were 4.00% and the value of the index rose by 6.80%, the cap amount of 4.00% would be credited to you contract. However, if the index change was 2%, your contract would be credited 2%, since that is lower than our hypothetical cap.

Participation rates

In some annuities, a participation rate determines what percentage of the index increase will be used to calculate your indexed interest. For example, let’s suppose that the index rose by 10%. If a hypothetical FIA had a 75% participation rate, the contract would receive 7.5% in indexed interest.

Spreads

In a few cases, the indexed interest rate credited is determined by subtracting a spread from an index’s gain during a specified period.

For example, if the index increased by 10% and your hypothetical annuity has a 4% spread, your indexed interest would be 6%. If the index only gained 2% for the year, the amount of the gain (2%) is less than the spread (4%), so no indexed interest would be credited and your contract value would remain unchanged.

Keep in mind that these components may change annually (for example, caps may be raised or lowered), but are typically subject to lifetime maximums or minimums.

Now let’s take a look at three types of crediting methods that are used to calculate your interest.

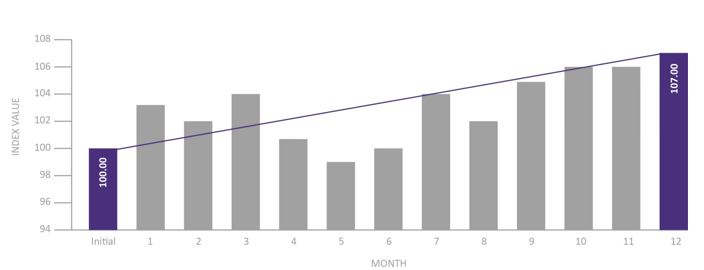

Annual point-to-point

This is the simplest of the crediting methods. Annual point-to-point uses the index value from only two points in time, so it may be a good choice if you want to minimize the effects of mid-year market volatility.

How it works:

- On your contract anniversary, the beginning index value is compared to the ending index value.

- The percentage of change in the index is calculated.

- If the ending index value is higher than the beginning index value, you will receive indexed interest. (How much interest you receive may depend on a participation rate, a cap, or a spread.)

- If the value is lower, you won’t receive indexed interest – but your contract’s value will be protected, and will not be reduced by market declines.

Example:

In this hypothetical example, the beginning index value (100) is subtracted from the ending index value (107), resulting in a change of 7%. The actual amount of indexed interest credited could depend on a participation rate, a cap, or a spread.

For example, if the participation rate were 50%, the indexed interest for this contract year would be 3.5% (50% of 7%).

Likewise, if the cap were less than 7.00%, the indexed interest for that year would equal the cap.

Finally, if this hypothetical example had a 2% spread, the indexed interest would equal 5% (7% change in index value – 2% spread = 5% indexed interest).

If the final result is negative, no indexed interest would be credited and your contract value would remain unchanged due to market declines.

This example represents hypothetical performance, used to show how a crediting method functions, and does not guarantee future results. Although an external index may affect your contract values, the contract does not directly participate in any stock or investments. You are not buying any bonds, shares of stock, or shares of an index fund. It is not possible to invest directly in an index. The market index value does not include the dividends paid on the stock underlying a stock index. These dividends are also not reflected in the interest credited to your contract.

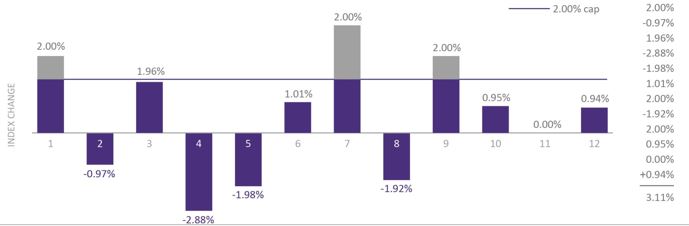

Monthly sum

Monthly sum is the most volatility-sensitive crediting method. It can provide interest in steady “up” markets, but it can be adversely affected by large monthly decreases.

How it works:

- On your contract anniversary each month, the index value is compared to the prior month’s value, and the percentage of change is calculated.

- At the end of the year, the contract’s monthly increases and decreases are added up. The increases may be subject to a cap; however, decreases are not limited by the cap.

- If the final sum is positive, you’ll receive that amount as indexed interest.

- If the final sum is negative, you’ll receive no indexed interest – but your contract’s value will be protected, and remain unchanged.

Example:

This hypothetical example illustrates monthly sum crediting, with a cap of 2.00%.

Every month, the index value is compared to the prior month’s value. The percentages you see below represent the percentage in index change, month-over-month.

At the end of the year, the monthly percentages are added up. In this example, the contract owner would receive 3.11% in indexed interest.

If there had been a participation rate, it would be applied to the 3.11% to get the indexed interest rate. For example, if the participation rate were 50%, the indexed interest for this contract year would be 1.55% (50% of 3.11%).

Likewise, if this hypothetical example had a 2% spread, the indexed interest would equal 1.11% (3.11% – 2% spread = 1.11% indexed interest).

If the final result is negative, no indexed interest would be credited and your contract value would remain unchanged.

This example represents hypothetical performance, used to show how a crediting method functions, and does not guarantee future results. Although an external index may affect your contract values, the contract does not directly participate in any stock or investments. You are not buying any bonds, shares of stock, or shares of an index fund. It is not possible to invest directly in an index. The market index value does not include the dividends paid on the stock underlying a stock index. These dividends are also not reflected in the interest credited to your contract.

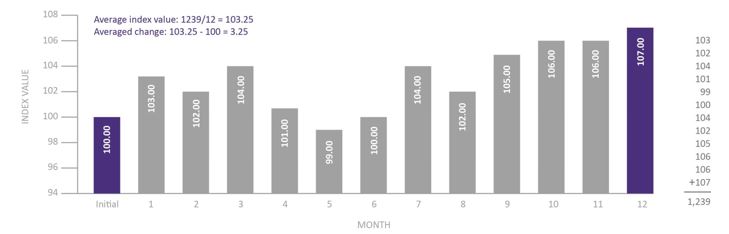

Monthly average

Monthly average can help reduce volatility by average monthly highs and lows over the course of the year. It may be a good choice when the market is turbulent.

How it works:

- The index values at the end of each month are tracked for one year.

- At the end of the year, those index values are added together and then divided by 12 to determine the monthly average.

- The starting index value is subtracted from the monthly average, and the result is divided by the starting index value.

- If the final result is positive, you’ll receive indexed interest. (How much interest you receive may depend on a participation rate, a cap, or a spread.) If the final result is negative, you’ll receive no indexed interest – but your contract’s value will be protected.

Example:

This hypothetical example illustrates monthly average crediting, with a spread of 2%. In this example, the contract owner would receive 1.25% in indexed interest (3.25% index change – 2% spread = 1.25% indexed interest).

If there had been a cap, it would be applied to the averaged index change. For example, if the cap were 2.00%, the indexed interest for that year would be 2%. However, if the cap were higher than 3.25%, the indexed interest would be 3.25%.

Likewise, if there had been a participation rate, it would be applied to the 3.25% to get the indexed interest rate. For example, if the participation rate were 50%, the indexed interest for this contract year would be 1.625% (50% of 3.25%).

If the final result is negative, no indexed interest would be credited and your contract would remain unchanged.

This example represents hypothetical performance, used to show how a crediting method functions, and does not guarantee future results. Although an external index may affect your contract values, the contract does not directly participate in any stock or investments. You are not buying any bonds, shares of stock, or shares of an index fund. It is not possible to invest directly in an index. The market index value does not include the dividends paid on the stock underlying a stock index. These dividends are also not reflected in the interest credited to your contract.

Crediting methods at a glance

The crediting method you choose can significantly impact how much indexed interest you receive. That’s why you should carefully consider your options, based on your overall financial strategy.

Remember that no single crediting method is best in all situations. In some market conditions, one crediting method may result in more interest than others – or zero interest in a given year. Also, keep in mind that some annuities may let you choose a combination of crediting methods.

This chart depicts the crediting methods’ relative sensitivity to index volatility and interest potential. It is intended only as an overview; please read the detailed descriptions of the crediting methods before you make a choice.

Some index crediting methods are more sensitive to volatility or changes in the market index.

And some index crediting methods offer – but do not guarantee – greater interest potential.

Fixed index annuities are designed to meet long term needs for retirement income, and they provide guarantees against the loss of principal and credited interest, and offer the reassurance of a death benefit for your beneficiaries.

Guarantees are backed by the financial strength and claims paying ability of the issuing carrier.

Product and feature availability may vary by state and carrier.