Wharton Financial Institutions Center

Policy Brief: Personal Finance

Investing your Lump Sum at Retirement

David F. Babbel

Fellow, Wharton Financial Institutions Center

Professor of Insurance and Finance

The Wharton School, University of Pennsylvania babbel@wharton.upenn.edu

Craig B. Merrill

Fellow, Wharton Financial Institutions Center

Professor of Finance and Insurance

The Marriott School of Management, Brigham Young University

Merrill @byu.edu

First Draft: June 10, 2006

This Draft: August 14, 2007

This essay is based, in part, on a study by the same authors entitled “Rational Decumulation,” Wharton Financial Institutions Center Working Paper #06-14, May 2007. That study was co- sponsored by the Wharton Financial Institutions Center and New York Life Insurance Company. The usual disclaimer applies.

Introduction

Imagine sitting down on the day of your retirement to plan your financial future. You know what your annual expenses have been and you want to maintain your current standard of living. So, you consult a recent mortality table and find that if you’ve made it to your 65th birthday, you can expect to live to 85 years old. You perform a little calculation and find that, together with your Social Security monthly payments, you have just enough savings to maintain your current standard of living and spend al of your savings and future expected earnings by the time you die at the age of 85. But, what if you live longer? Will you be reduced to eking out an existence on Social Security alone? Where will the additional money come from? What if future investment returns are not what you anticipated at the start of your retirement? These questions are increasingly urgent in America today, as forces are combining to make planning for outliving your resources more important than it has been in the past. Old rules of thumb for spending your assets in retirement, called decumulation, need to be reconsidered.

The Perfect Storm

Retirees must take strategic action in the deployment of their accumulated savings and funds as they begin retirement. Five forces are converging upon Americans in what some have called the Perfect Storm – others the Tsunami Wave – that is about to engulf us from al sides.1 The best we can do is to organize our own finances in such a way that we can provide for ourselves, because there isn’t anything we can do to stop these converging forces. These five forces are:

1) The decreasing levels and importance of Social Security benefits.

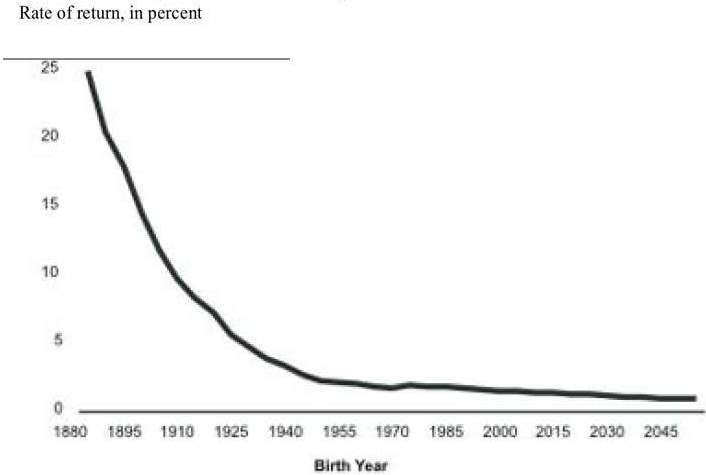

Relative to the benefits provided to our parents, people currently in their working years will receive a much lower return on their Social Security contributions. As can be seen in the chart below, the implicit rate of return on contributions was far higher for earlier beneficiaries. [Source: Social Security Administration.]

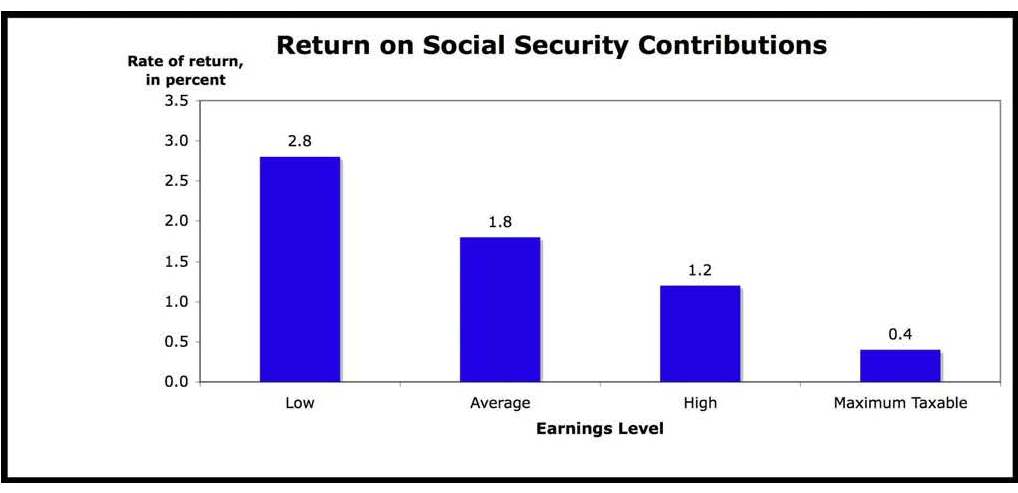

The adverse effect of this lower rate of return especial y impacts the higher contributors, as shown below. This chart shows that people who had the lowest earnings levels are projected to receive a rate of return on their contributions of 2.8%, seven times higher than 0.4% returns that are projected for those whose earnings were taxed at the maximum levels. However, the rates of return for both groups are very low. [Source: Social Security Administration.]

2) The demise of defined benefit (DB) pensions. Over the past 15 years, there has been only one new pension program of any size initiated in the U.S. The number of pension plans in the U.S. peaked at 175,000 in 1983, and has since declined to less than 25,000. While much of the reduction was due to the elimination of small and medium plans, some of the largest pension programs have also been discontinued, closed to new membership, or frozen to all employees. About 30% of the remaining pension programs plan to do close within the coming two years.2 Many of those that still remain are insolvent or otherwise under funded, and the government’s Pension Benefit Guarantee Corporation (PBGC) is reeling under a load it cannot sustain. During the same time period, 401(k) defined contribution (DC) plans in-creased from around 17,000 to over 450,000. When al defined contribution type plans are included, there are over 650,000 today. While the reasons for the substitution of DC for DB plans are complex and cannot be covered here, suffice it to say that there is a dynamic change going on in response to various economic factors and government initiatives that will change the way we cope with retirement income needs. Over time, the problem is bound to get worse.

The economic implications for the average individual are significant. Under a traditional pension program, the retiree receives a set monthly income for as long as he or she lives. Under a defined contribution program, such as a 401(k) or 403(b) program, the amount of income you collect after retirement and how long you continue to receive it is anyone’s guess. There are no guarantees. In effect, the risk of retirement has been shifted away from the employer and the PBGC that insures the pension benefits, and placed upon the shoulders of the employee. Put another way, the financial risk of retirement has been transferred from those best able to bear it to those less knowledgeable and least able to bear it. In the past, annuitization (discussed below) was less important, as pensions were combined with Social Security and handled most of our retirement needs. But today, as pension benefits are gradually (and at times, suddenly) eliminated, and as Social Security benefits stagnate, and are sometimes reduced through delayed eligibility and taxation, annuitization becomes a much more important retirement strategy.

3) The aging of the baby boom generation. Beginning last year, the first members of the largest generation in American history turned 60, leaving their jobs and entering the retirement force. The “boomers,” as this generation is commonly known (born from 1946 to 1964), will continue to exit the workforce for at least another twenty years. Currently constituting over 27% of the U.S. population and 47% of all households, they will become dependent upon Social Security, retirement plans, and any accumulated assets.

4) The emergence of post boomers. Generations X (born between 1965 and 1979) and Y (born between 1980 and 2001) will be burdened not only with the responsibility of providing for their own future retirement and health needs, but also with supporting the Social Security and Medicare costs of the boomers. The net effect of this is that there will soon be many more people draining funds from the Social Security system, with far fewer people contributing to it.

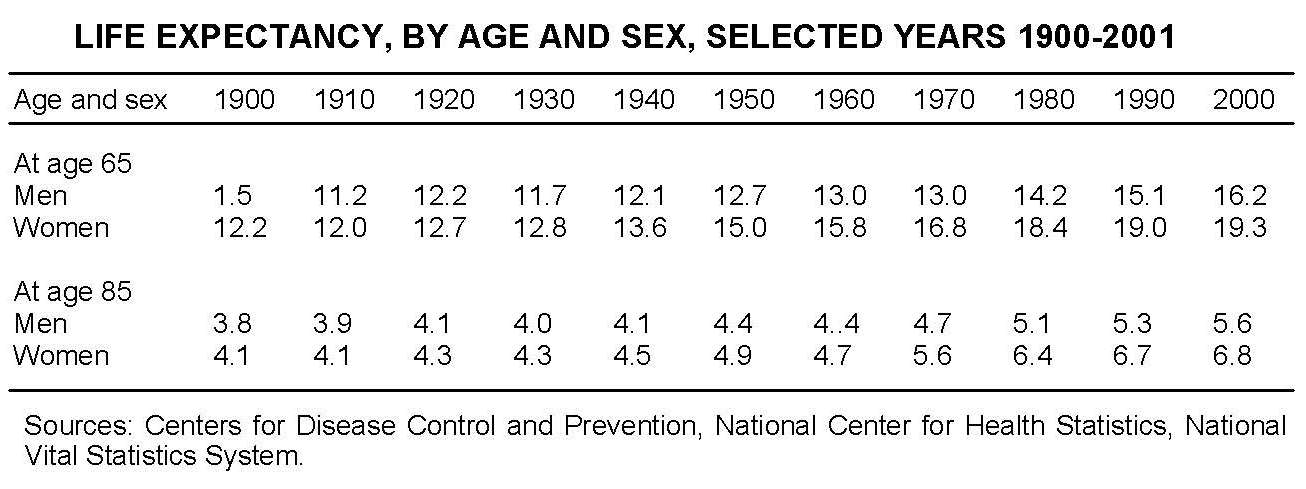

5) The increasing longevity of the American population. In the table below, we show how the life expectancy for the population at large has increased over the past century. While expected lifetimes are longer in all categories, the life expectancies for people who reach age 65 are the most relevant for our analysis.

An examination of the table shows that since Social Security began monthly payments in 1940, the number of months we can expect to receive benefits for those of us who reach age 65 has increased by roughly 50% for men and women. Coupled with the fact that when Social Security was instituted, the average person did not live to age 65, increased longevity has placed a tremendous burden upon the retirement system. It should be kept in mind when reviewing this table that these are life expectancies for the population at large. For people who reach age 65 in good health, the life expectancies are currently about four years longer than shown, and remember that half of those people will live longer, many much longer. When considered together with the decreasing yields from bonds and lower returns from stocks in recent years, these forces spell disaster for those who do not take more prudent financial measures to prepare for what is becoming the major financial risk of the 21st century: living too long.

So there you have it. The decreasing rates of return on our Social Security contributions, the accelerating demise of defined benefit pensions, combined with the advent of America’s largest generation in history now approaching retirement, their longer expected lifetimes, and the much smaller relative population of people who are going to be asked to support their unfunded benefits – taken together we have all the necessary ingredients for the perfect storm – with a few extra ingredients thrown in for bad measure!

What is Annuitization?

Lifetime income annuities, sometimes called life annuities, income annuities, single premium immediate annuities, or payout annuities, involve large insurers pooling people of similar age and sex, with each person giving to the insurer an amount that will generate sufficient returns to provide them with a monthly income throughout their expected lifetimes. Those who die before reaching their life expectancy are, in effect, insuring those who live beyond their life expectancy. In essence, it is the opposite of life insurance, where the payments of those who remain living go to cover the benefits paid to the estates of those who die prematurely. In the case of life annuities, the risk of outliving one’s income is pooled among all annuity purchases, providing a kind of insurance against outliving one’s assets.

If, at retirement, people plan their finances to cover their economic needs throughout the remainder of their expected lifetime, which is roughly until age 86, half of them can be expected to fail. This is simply because half will live longer and many much longer, than their life expectancy. (See chart below.)

However, if they choose a life annuity instead, they will be able to spend at the same rate, but be covered for as long as they live. A life annuity is the only investment vehicle that features this advantage. Trying to replicate this advantage of a secure lifetime income, but without the risk-pooling of a life annuity, will cost you from 25% to 40% more money, because you would need to set aside enough money to last throughout your entire Possible lifetime, instead of simply enough to last throughout your expected lifetime. Even at this higher cost, you cannot be sure you will achieve a secure lifetime income, because interest rates could change over the next 30-50 years while you are in retirement. (We will discuss this later.)

Economists’ Views of Decumulation

George Bernard Shaw once quipped, “If you laid all the economists end to end, they still wouldn’t reach a conclusion.” Well, that time-honored adage has changed, at least in one area, because economists have come to agreement from Germany to New Zealand, and from Israel to Canada, that annuitization of a substantial portion of retirement wealth is the best way to go. The list of economists who have discovered this includes some of the most prominent in the world, among who are Nobel Prize winners. Studies supporting this conclusion have been conducted at such heralded universities and business schools as MIT, The Wharton School, Berkeley, Chicago, Yale, Harvard, London Business School, Illinois, Hebrew University, and Carnegie Mellon, just to name a few. The value of annuities in retirement seems to be a rare area of consensus among economists.

A recent National Bureau of Economics study, which appeared in the prestigious American Economic Review, demonstrated under much more plausible conditions than had ever been supposed, that full annuitization was optimal for people who had no desire to leave a bequest to their heirs or charitable organizations.3 It also concluded that for those with bequest motives, substantial annuitization of retirement wealth was still the most prudent way to act.

In another recent study, we re-examined the unique features of annuitization and showed that people who place their retirement wealth in mutual funds of stock, bonds, the money market, or some combination thereof are subjected to greater risk, often higher expenses, and returns that are unlikely to keep pace with annuity returns, especially when risk is taken into account. The recommendations from our study as well as existing academic models are below.

Recommendations

Like others before us, we found that substantial annuitization was generally prescribed by a sophisticated model of economic decision-making. The reason we conducted yet another study of this was to incorporate several degrees of greater realism that had not been included in earlier economic models, and to re-examine the annuitization decision in this richer economic context.

The level of annuitization that was considered optimal depended on a number of factors, such as amount of wealth at retirement, level of Social Security benefits accrued, tolerance for risk, desire to leave a bequest, impatience to consume, general level of interest rates, expected return on stock, and stock market risk levels. It also depended on marital status, age, and whether pension income was being earned.

While we cannot present here all of the scenarios that were examined, we can give some general conclusions about what our study showed.

- You should begin by annuitizing enough of your assets so that you can provide for 100% of your minimum acceptable level of retirement income. Annuitization provides the only viable way to achieve this security without spending a lot more money. The economic models invariably attest to this fact – that the cost of not being able to cover basic expenses far exceeds the potential upside of taking on additional equity exposure. In calculating how much to annuitize privately, subtract from what is needed each month from the amount you will be getting from Social Security and any pension benefits you may have accrued.

Then annuitize a sufficient amount of your assets to provide for the remainder of the monthly income you will need to reach that threshold level.

- Next, our study shows that you will generally need to annuitize a significant portion of your remaining wealth, while investing the balance in stocks, fixed income securities, and money markets. The economic models of rational behavior, which weigh the riskiness of outcomes against a person’s tolerance for risk, all show that equities and fixed income are not substitutes for annuities, because they do not address the major risk we face of outliving our assets. For this reason, economists’ generally considers life annuities to be a separate asset class. Equities and fixed income can be complements to, but cannot replicate nor substitute for annuitization. How much of the remaining wealth should go to life annuities will depend on the factors discussed below.

a) You will want to make provisions for any extraordinary expenses, such as uncovered health costs and institutional car These gaps in coverage can be purchased through supplemental health and long-term care insurance, or perhaps from a rider to a life annuity that increases the payments beyond a certain age. For example, suppose that you receive Social Security benefits of $20,000 per year, and life annuity payments of $25,000 each year, for a total annual income of $45,000. If long-term institutional care costs around $70,000 per year, you will need to get an annuity rider that doubles your annual annuity income to $50,000, to begin at the age when you are more likely to need institutional care. Taken together with your Social Security, you will reach the targeted income level. Since Social Security is linked to inflation, and the cost of long-term care is influenced by inflation, you may need to allocate a portion of your private annuity money to a contract that provides some escalation in benefits over time.

b) You will want to make provision for your heirs, but balance this provision against your own desire to live above your minimum acceptable living standard. Since the non-annuitized wealth is generally for your heirs, its present value is the same whether you give it to them now or later, because future benefits will be discounted by current Although your heirs might appreciate it more now, at least it is not likely to go away if you live beyond your life expectancy, owing to your decision to annuitize the amount of assets necessary to provide you with a decent living, no matter how long you live.

c) Our study found, as have most other studies, that the greater the tolerance you have for financial risk, the higher the proportion of your excess assets – i.e., assets that are not needed to provide for your minimum acceptable standard of living – could be placed in stock or other risky inv We never found this level to be much above half of your excess assets. For example, if it takes 60% of your lump sum distribution at retirement, together with Social Security and any pension benefits, to provide the mini-mum level of income you will need, up to half of the remaining 40% of your assets can be placed in stock if you are exceedingly tolerant of financial risk. In cases where individuals have lower tolerance for financial risk, the portion of excess assets that can be allocated to stock declines to 10% – 30% at age 65. In contrast, optimal annuitization of the excess assets ranges from 40% to 80%, and non- annuitized fixed income general y is 5% or less of your excess assets.

d) Remember, these generalizations depend on the size of bequest you wish to leave, as well as a host of other financial assum One of the assumptions used in the full study was a markup on life annuities of 10%, which is quite a bit higher than we have found in recent months. Today’s lower markups would justify even higher levels of annuitization. Finally, we suggest that annuities be purchased only from the most financially sound insurance providers. You will be able to sleep a lot better!

Why Don’t More People Annuitize – Reasons and Excuses (or, Annuity Myths)

While public and private annuitization (i.e., Social Security and pensions) were heavy in the past, relatively few Americans not covered by pensions today have chosen to annuitize their wealth through private annuity purchases. Given the alarming confluence of economic and demographic changes occurring today, the number of people choosing life annuities should be larger than ever.

Many market participants believe that “stocks for the long run” is the way to go.4 But our study showed that over the long haul, unless stocks achieve excess returns above Treasury bonds at least twice as high as they are generally expected to generate, it often makes more sense to annuitize most of ones wealth at retirement. So why don’t more people annuitize? Here are some common myths about annuities.

- They cost too much!

The market for life annuities has become very competitive in recent years, and today the markups in price (“loadings” in insurance parlance) are very low for the people who actually purchase them. During the past decade, these markups above actuarial y fair prices have come down from around 6 – 10% to less than half that level from the top companies, approaching zero in some cases.5 Of course, if you are unhealthy at 65, and have low prospects to regain your health, an annuity purchase may not be the way to go. However, you will be putting your own financial future at risk in so doing, because you really do not know what medical advances will occur, or how long you will live. Compare the 0% – 5% one-time markups on life annuities with the 1% – 2% annual expense ratios levied by typical mutual funds, as well as front-end or back-end loads that sometimes reach as high as 8%, and life annuities compare favorably. And don’t forget that life annuities, with their one-time markups, offer lifetime income security. In contrast, mutual funds offer no such guarantees against outliving ones assets.

- What if I get sick?

There are three ways to provide for hospitalization and nursing care costs that are not picked up by Medicare. Supplemental health insurance can be purchased that covers gaps in Medicare coverage. Long-term care insurance can be used to supplement monthly income to meet the high costs of institutional care, which at the beginning of this decade had already reached an average of $70,080 a year for a private room and $61,685 for a semi-private room.6 The third way might be the least expensive of all, although it does carry some risk. Life annuities are now available that will increase monthly payments by up to 400% when the annuitant reaches a specific age, e.g., 85 years of age. The annuitant can choose an age when the need for institutional care begins to become more likely, and select the desired level of in-crease in payments. While annuities with this feature cost more than regular annuities that provide level payments throughout life, they can be well worth the extra cost. The risk is that you might need institutional care before the higher income begins at age 85. If, on the other hand, your need doesn’t arise by age 85, count your blessings and use the extra income for something else, or save it for a rainy day. Other innovative life annuities allow you to withdraw as much as 30% of your future payments at five-year intervals, or in case of losses because of a fire, flood, or other natural disaster.

Yes, some of these provisions cost extra money, but you can pay for them now, or pay later at perhaps much higher prices. None of them are really excuses for not annuitizing a substantial proportion of your remaining wealth at retirement.

- What if inflation returns? Won’t my fixed payments become worth less?

Life annuities have evolved considerably over the past several years to address this problem. Today a retiree can elect to have his or her monthly payments increase at rates ranging up to 6% per year. Alternatively, inflation-linked life annuities can be purchased. Both kinds of inflation protection entail receiving lower initial payments, but they grow over time. Indeed, annuities are now available that make it possible to achieve a wide range of income patterns over one’s remaining lifetime, to address different economic needs.

Investment horizon requires lower, not higher, allocations to risky assets. See Eric Jacquier, Alex Kane and Alan J. Marcus, “Optimal estimation of the risk premium for the long run and asset allocation: A case of compounded estimation risk.” Journal of Financial Econometrics, Vol. 3:1 (Winter 2005), 37-55.

- Isn’t it cheaper to use some sort of homemade strategy that mimics the behavior of life annuities? That way I can cut out the insurer!

This would be nice, but it is a fantasy. We don’t notice people doing this with life insurance. Why not? Because it takes an insurer to assemble a large pool of thousands of people to fund the payments that go to people who die prematurely. A large pool is also needed to provide predictability and efficient pricing to the provider of insurance, as well as to the consumer. The same pooling principle is behind life annuities, and allows insurers to offer monthly payments throughout your life, no matter how long you live. It is difficult to form a viable pool size if you try this at home on your own!

That hasn’t stopped financial economists from experimenting with close to a dozen different investing and budgeting plans to see if mimicking the desirable attributes of life annuities can be done successfully.7 Thus far, each one exposes the retiree to the possibility of suffering sustained periods of inadequate income, at times even below survival income level. Financial

planners sometimes say that a particular favored system may give you a good chance of significantly higher investment returns if your savings are placed in equities or some other favored investment. That may be true. But such homemade systems also carry a risk of running out of income long before one runs out of life. Their sponsors may counter that the risk of such an eventuality, if everything goes according to assumptions and the plan is followed tightly, may be only 15%. That is roughly equivalent to the 16.7% odds of losing in a game of Russian roulette, and few people are prone to participate in such games! Why, then, are people so prone to bet their own income security when it comes to retirement? And what if a particular scheme, by giving up a little of the upside, reduces the chances of failure to half that level? It is sort of like the comfort one receives by substituting a twelve-shooter with eleven empty chambers for the six-shooter.… We have calculated that under today’s interest rates, it would take from 25% to 40% more of your wealth to achieve the same secure level of income throughout your possible lifetime that you can get through annuitization. Yes, if you happen to die earlier, you could get by for less and give what remains to your heirs. But if you annuitize, you could give away that 25% to 40% extra cost of providing for longevity contingencies, either now or later, as we explain under Item 5 below.

Another problem with such homemade annuities is the lack of predictability. Phased withdrawal plans require adherence to a strict discipline over the remainder of your life. They require you to consume for many years at a substantial y lower rate than the life annuity withdrawal rate in order to maximize the probability that you won’t run out of money too soon. What if you, in a moment of weakness, violate the discipline? Moreover, all of the projections about the probabilities that a particular phased withdrawal plan will work in practice are based on distributional assumptions. That is a statistician’s way of saying that the behavior of the investment in question is being correctly modeled. Quite frankly, we really don’t know what the future distribution of returns will be over the next 30 to 50 years, and whether it will match our assumed distribution. While we will not discuss here the important technicalities and economic ramifications of the assumptions embedded in the return distributions used in these programs, suffice it to say that many financial economists have serious concerns about them. Returning to our Russian roulette example, we may know how many chambers are in the pistol, but we don’t really know how many of them are empty.

- If I put all of my money in a life annuity, will there be anything left for my kids?

There are several levels upon which this valid question can be answered. First, assume that you put all of your money in life annuities (which we do not advocate). If you have enough money to give some to your heirs, yet place it al in life annuities, the monthly payments will likely be more than you need to maintain your lifestyle. Therefore, the excess could be saved and passed on to them. The longer you live, the more excess will be available for your heirs.

But if you die soon, there will be very little to pass along. This can be remedied by using some of the extra monthly annuity income to purchase renewable term life insurance, or whole life insurance, which can generate a sizable sum to pass along at death. Alternatively, you could purchase a life annuity with a feature that continues making payments for up to twenty years, or that refunds to your heirs that portion of the premium which has not been received in income, if death occurs within a selected time interval.

Furthermore, if you do not annuitize a substantial portion of your retirement wealth, you pass the financial risk of outliving your resources along to your relatives and children, not to a broad pool. In such cases, your heirs could receive a windfall if you die prematurely, but very little or nothing if you live longer. In essence, lack of annuitization puts the heirs’ economic incentives averse to your own (assuming that you wish to provide a comfortable living for yourself in your old age), whereas annuitization resolves the conflict.

If you determine how much income per month you need to live comfortably for the rest of your life, and fund it, can you give away the rest? Yes, if you annuitize the portion of your wealth that is needed, setting aside some additional funds to cover unforeseen needs (perhaps through insurance). You will continue to receive a comfortable income throughout the remainder of your lifetime. The rest of your wealth you can give away today, if you like, or at the end of your life, if you prefer. The present value is the same, but the heirs may be able to make better use of it if they receive it earlier than later, to cover their children’s college expenses, help them get into a house, or other such needs. It is likely that if the heirs were consulted, their preference would be nearly universal for receiving a certain bequest up front, along with a smaller residual claim, than to leave everything for upwards of 40 years and possibly receive nothing.

But suppose you instead invest in some combination of mutual funds the same amount that it would have taken to securely provide for your needs through annuitization. In so doing, your heirs become residual claimants. That is, they receive only what is left over after your passing. Ironically, the longer you live (and thereby the more you consume of your wealth), the less there will be left over for your loved ones. And if you live a long life, you may need your children to care for your physical, emotional, and financial needs. Thus, the longer they care for you, the less they will receive for their efforts (in present value terms). Under annuitization, the insurers absorb all of the longevity risk. Without annuitization, the heirs absorb all of the risk rather than the insurers.

How much better would it be to provide your heirs with a substantial legacy up front, upon retirement or perhaps even earlier, and then, at the end of your life, they can be residual claimants for personal effects and any unused funds?

- If I purchase an irrevocable life annuity at retirement, don’t I lose control over those funds?

Yes. And thankfully, so do your kids! One of the most difficult situations in which older people find themselves occurs when there are many people trying to get their hands on your hard-earned money. Let’s face it. Some of us get rather feeble as we age, and our judgment sometimes lapses. We become vulnerable to impassioned pleas from others to “ante up” our savings to them. How many aged people have lost everything in such situations, sometimes even to well-intentioned recipients? Moreover, it also greatly reduces the risk of us overspending.

There is another reason to place these funds beyond our direct control. A recent study has shown that older people typically earn roughly 2% lower annual returns on their stock portfolios, even when adjusted for risk, than investors younger than 60.8 Sometimes it is best to leave your funds in the hands of experienced professionals, especially when they have contractual requirements to provide you with a well-defined stream of desired benefits, and where their contract is backed by the assets and the entire surplus of a financially solid company. Remember, the greatest economic risk we face today is that we will live longer than our income stream. Sometimes we pay a very high price for maintaining what we think is control.

- Shouldn’t I wait to buy in case interest rates go up?

Some people delay annuitizing in the hopes that they can get higher annuity yields if interest rates increase. Very briefly, here are the issues.

It is true that if interest rates increase, annuity yields might also increase. But there are some mitigating factors to consider if you’re thinking about delaying to annuitize. First, your accumulated assets need to be invested in something during the interim while awaiting the time to purchase a life annuity. If invested in traditional vehicles, such as fixed income and equities, the value erosion that typically accompanies rising interest rates may offset part or all of the gain that one hopes to garner by delaying the annuitization decision. Second, if life expectancy improves beyond the rate of improvement assumed in current pricing, the prices of the annuities themselves will climb. We calculated that a 1% annual improvement in life expectancy is associated with roughly a 5% increase in the price of an annuity, or a 5% reduction in monthly payouts. This decline in monthly annuity payouts may be offset if the interest rate embedded in annuity pricing also increases, but it needs to increase sufficiently to offset any reduction caused by an unanticipated improvement in life expectancy as well as the probable reduction in accumulated as-set values occasioned by high interest rates during the delay period. Third, the awaited rising interest rates may not occur; indeed, the interest rates embedded in annuity pricing may remain stable or decline, leaving the annuitant with lower monthly payments. If interest rates and mortality rates decline together, these income reductions could be substantial.

Nonetheless, recent innovations in life annuity designs include one that allows the annuitant a second shot at higher interest rates. For example, one such product adjusts monthly annuity payments upward by roughly 18% if interest rates increase by 2% or more over the five years since purchase.

Conclusion

When individuals consider the list of positive attributes associated with life annuities, i.e., guaranteed payments you cannot outlive, low cost, access to invested capital, and reasonably priced features such as inflation adjustment and legacy benefits, the argument for this income solution in retirement is compelling. By covering at least basic expenses with lifetime income annuities, retirees are able to focus on discretionary funds as a source for enjoyment. Locking in basic expenses also means that the retiree’s discretionary funds can remain invested in equities for a longer period of time, bringing the benefits of historically higher returns that can stretch the useful life of those funds even further. Income annuities may also be a vehicle that enables retirees to delay taking Social Security benefits until they are fully vested, bringing substantial y higher payments at that point. The key in all of this is to begin by covering all of the basic living expenses with lifetime income annuities. Then, to provide for additional desirable consumption levels, you will want to annuitize a goodly portion of the remainder of your assets, while making provisions for extra emergency expenses and, if desired, a bequest. These last two items can be accomplished through combinations of insurance and savings. When this is undertaken, you can enjoy your retirement without the burden of financial worries and focus on more productive uses of your time and attention!