The effects of Inflation should be considered when planning for retirement

Since inflation can impact the value of your retirement income, consider an annuity with benefits available to suit your income needs.

When you’re working, your income generally increases along with inflation. However, when you’re retired, will you have a retirement income plan that provides an increasing income stream that you cannot outlive?

Looking back in time to 1985, you paid $2.26 for a gallon of milk; today’s cost is around $3.29.1 That’s an example of inflation at work, as the price of goods and services purchased by U.S. households increases over time.

During a person’s working years, they are periodically getting a cost-of-living increase, in terms of salary and/ or commissions, which serve to help keep pace with rising prices.

But in retirement, if you are receiving a fixed income, as prices keep rising, your purchasing power keeps diminishing. Even though your income hasn’t changed, it buys you less and less as the years go by.

The problem: The rising costs of goods and services.

The inflation rate is calculated from the Consumer Price Index (CPI), which is compiled by the U.S. Bureau of Labor Statistics. It is based on the cost of a representative basket of goods of a typical urban consumer.

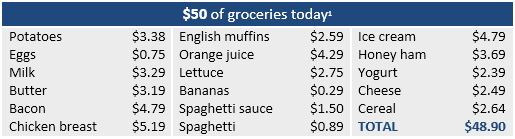

For example, if you retired this year, $50 worth of groceries might include these items:

Source: 11980’s Flashback, 1980 Economy/Prices, http://www.1980sflashback.com.U.S.

published 2001

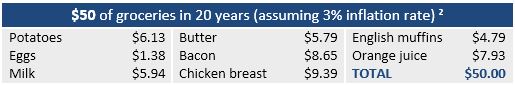

But with a 3% annual inflation rate (which historically has been the U.S. average), in

20 years, that same $50 would buy quite a bit less:

This is a hypothetical example

Source: 2InflationData.com, http://inflationdata.com/inflation/Inflation_Rate/HistoricalInflation.aspx.

The following hypothetical example uses actual Consumer Price Index for All Urban Consumers (CPI-U) data from 1992 – 2012. This chart is intended to show the impact on the purchasing power of a level $10,000 income payment versus that of a CPI-U linked income payment in an inflationary environment. Since the CPI-U linked payment was recalculated each year to reflect increases in the CPI-U value, the effective purchasing power of that payment remained constant while the purchasing power of the “level” payment decline by nearly 40% over that 20 years.

A possible solution: fixed index annuities with increasing income options

Fixed index annuities are long-term insurance products that can help meet your income needs. FIAs offer a source of predictable income payments, while offering benefits traditionally associated with fixed annuities, such as:

ability to earn interest, protection of premium and credited interest from market declines, income tax deferral and guaranteed lifetime income.

As an alternative to annuitization, a number of today’s FIAs offer income withdrawal benefits, either built into the cost of the product or available at an additional fee, which provide lifetime income withdrawals without having to annuitize the contract. The lifetime income provided is guaranteed, and some annuities provide the opportunity for increasing income to help offset the effects of inflation. Product features and availability will vary by state and carrier.

Particular annuities have income benefits that offer increasing income, either built in or as optional riders for an additional cost.

As you can see in this example, a level payment would have lost nearly 40% of its effective buying power from 1992 to 2012. The purchasing power of the CPI-U linked payment remains constant – which may lead you to ask yourself, “Is a ‘level’ income payment really level?”

This is not a comprehensive presentation on these products. For more information about fixed index annuities and income riders.

Annuities are long term products and may be subject to surrender charges and holding periods

Withdrawals are subject to ordinary income tax and, if taken prior to age 59 ½, to a 10% federal penalty tax may result in loss of principal and credited interest due to surrender charges.

Guarantees are backed by the financial strength and claims-paying ability of the insurance company.

- Not FDIC insured ● May lose value ● No bank or credit union guarantee ● Not a deposit ● Not insured by any federal government agency or NCUA/NCUSIF