Increasing retirement income is important, and a fixed-indexed annuity (FIA) can help.

If you’re wondering whether you’ll have enough money, or enough retirement income to support your lifestyle, you’re not alone.

According to a recent study titled Reclaiming the Future, conducted by Allianz Life Insurance Company, 51% of the people who participated said they were “extremely concerned” about the possibility of outliving their income.1

Some people will try to address this common concern by withdrawing no more than 4% to 5% of their assets annually, in retirement. Next, they will try to increase the amount withdrawn the following year by 3%, in an attempt to keep up with inflation.2

Unfortunately, as time goes on the amount of the withdrawals continue to grow, and they represent an ever-larger percentage of the asset’s remaining value. During retirement, that means you could find yourself having to choose between living with less income, or increasing your risk of running out of money.

A potential solution for your retirement income needs

Fixed-indexed annuities (FIAs) offer a reliable source of predictable income payments, while offering all of the benefits traditionally associated with fixed annuities, such as:

- The ability to earn interest and grow your principal

- Protection of your entire account value from market volatility or downturns, including both your original principal plus any credited interest

- Tax deferral

- Guaranteed income for life

Some FIAs offer additional benefits, such as providing an increasing retirement income

A number of fixed-indexed annuities now offer lifetime income withdrawal benefits that are available either at an additional cost, or included with no additional fees.

Although all can provide lifetime income withdrawals, these income benefits are not all alike. The fact is, the amount of value you actually receive from one particular lifetime income withdrawal benefit, versus another, can vary significantly. So it’s important to understand how they work. It’s important to understand the differences when making such decisions. This knowledge puts you in a position to make an informed decision as to which income solution is the best choice for you.

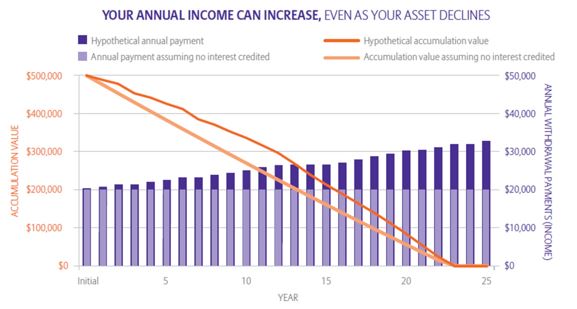

Let’s take a look at how a fixed-indexed annuity (FIA) lifetime income withdrawal benefit gives you the opportunity to receive increasing income on a declining asset.

1The Allianz Reclaiming the Future Study: One year later (Pulse Survey), 2011, commissioned by Allianz Life Insurance Company of North America.

2Somnath Basu, “Mistiming Retirement,” Financial Advisor, February 2011, p. 32.

Distributions are subject to ordinary income tax and, if taken prior to age 59 ½, a 10% federal penalty tax may apply.

Material must be used with applicable fixed index annuity consumer brochure and income benefit rider brochure, if applicable.

Guarantees are backed by the financial strength and claims-paying ability of the insurance company.

Product and feature availability may vary by state and broker/dealer.

Increasing guaranteed income keeps up with inflation, enabling the consumer to maintain purchasing power

An insurance company can provide fixed-Indexed annuities (FIAs) that generate a set amount of guaranteed lifetime income. Some may also provide the opportunity for increasing income to help offset the effects of inflation.

With some FIA lifetime income withdrawal benefits, you can have an option that guarantees income increases following every year the contract earns interest. You can receive these potential annual increases in your lifetime income withdrawals despite any decline in the contract’s remaining account value. Typically, the trade-off for this increasing income opportunity is a starting income withdrawal that is lower than the traditional level income option. There are FIAs available where that is not the case. The tradeoff with this FIA is that the income rider generates your withdrawal amount based upon performance interest earned. This is referred to as a Type #2 FIA.

In this hypothetical example, at the end of 25 years, the income would have increased by 63% from the starting amount of $20,000 to $32,591.

With certain FIA lifetime income withdrawal benefits, you can receive income increases, even as the value of your accumulated assets decline, diminishing all the way to zero. This is a unique benefit of utilizing an annuity issued by a life insurance company, as it provides lifetime income, even after an account value may go to “zero”.

1To be eligible for increasing income payments through withdrawals, you must choose a payout option that is offering increasing income payments and meet all contract conditions (which may include a waiting period usually referred to as a “deferral period”, and a minimum age requirement may come into the picture, as one needs to reach the attained age of 591/2 ). Please keep in mind that different insurance companies and different products will handle the increasing income opportunity differently, so please view this description as hypothetical, your financial professional will provide material specific to the product they discuss with you, and all particulars, withdrawal rates, and opportunities for increasing income, will vary based on the terms of the specific product in question, or that is being discussed. Please keep in mind that taking withdrawals in excess of the maximum or allowable withdrawal amount may reduce the following year’s income withdrawal amount.

This hypothetical example is intended to show how the lifetime income withdrawals offered by select fixed-indexed annuities may have worked, had they been available. Please note, this hypothetical annuity and lifetime income withdrawal benefit you just read about were not available during most of the time period shown. Also, this is not a comprehensive overview of all the relevant annuity features and benefits. Be sure to review all material details about these products.

This hypothetical example is based on actual S&P 500® Index historical performance from 12/31/1987 to 12/31/2012, and assumes the product had been available and was able to begin lifetime income withdrawals on 1/1/1988. The illustration assumes an initial lifetime income withdrawal value of $500,000 and an annual point-to-point crediting method with a hypothetical annual cap of 2.75%. The cap in this example is declared annually and is guaranteed to never be less than a certain percentage, for example 0.25%. The minimum annual lifetime income withdrawal is $20,000, assuming a 0% credited interest rate in all years.

This hypothetical past interest crediting may not be used to predict or project future results, and is used only as an example. Different time periods would yield different results. Actual results will vary by the specific product and allocations, crediting method, caps, spreads, or participation rates chosen. No single crediting method consistently delivers the most interest under all market conditions. Although external indexes may affect the contract values, the contract does not directly participate in any stock or other investments. The purchaser is not buying bonds, shares of a stock, or shares of an index fund. The indexed linked interest rates do not include the dividends paid on the stocks underlying a stock index.

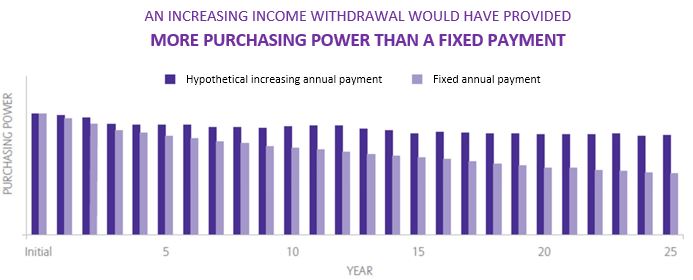

Why increasing retirement income is important: The effect of inflation

When considering the value of increasing income, you should also take into account how inflation – a rise in the price of goods and services – can reduce your purchasing power. If your overall income doesn’t change, it will buy you less and less over time as inflation increases because goods become more expensive.

As we saw in the previous example, the hypothetical annual lifetime income withdrawal from the FIA with increasing income potential, would have seen an income benefit that increased by 63% after 25 years, from $20,000 to $32,591.

Over that 25 year period, if you had income payments that remained at a constant $20,000, even though your payments did not decrease, the purchasing power of the payments you did receive would have decreased dramatically.

RESULT

RESULT

Using the actual Consumer Price Index (CPI-U) inflation figures, we can see that even though the fixed payment remained the same for all 25 years, that income payment’s purchasing power was actually 50% less in the 25th year than it was when you would have received that 1st payment in year 1.

Of course, even the increasing lifetime income withdrawals were affected by inflation, as the increased payment of $32,591 had lost purchasing power. The effect is that you bought 18% less goods and services as the original $20,000 bought 25 years earlier, when payments were initiated. However, because the lifetime income withdrawal / payments increased over the 25-year period following any year your allocations earned interest, the increasing income withdrawal benefit would have provided substantially more buying power, 63% more at the end of the 25 years, than if the income payments would have remained level.

This hypothetical example is based on actual historical S&P 500® Index performance and Consumer Price Index data from 12/31/1987 to 12/31/2012. The guaranteed payment, assuming no crediting of any interest, over this time frame equals the fixed annual payment.

Standard & Poor’s 500® Index (S&P 500®) is comprised of 500 stocks representing major U.S. industrial sectors. “Standard & Poor’s®,” “S&P®,” “S&P 500,” “Standard & Poor’s 500,” and “500” are trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use by many Life Insurance Companies.

S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”). This trademark has been licensed for use by S&P Dow Jones Indices LLC and its affiliates. S&P® and S&P 500® are trademarks of S&P. These trademarks have been sublicensed for certain purposes by Life Insurance Companies. The S&P 500 is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Insurance Companies. A Insurance Company’s products are not sponsored, endorsed, sold, or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates make any representation regarding the advisability of investing in such product.