Does your portfolio have too much interest rate risk?

How would a rising interest rate environment affect your portfolio?

As the graph below shows, we’ve had three decades of a general trend in the baseline of declining interest rates – and with it, lower prices for newly issued bonds.

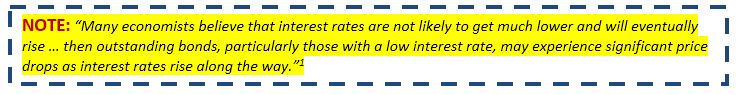

But with interest rates at their lowest levels since the 1950s, the Financial Industry Regulatory Authority recently issued this alert to investors:

According to Ben S. Bernanke, former Federal Reserve chairman, experts on the Federal Open Market Committee expect the first increase in the federal funds rate to occur in 2015 or 2016.2

According to Ben S. Bernanke, former Federal Reserve chairman, experts on the Federal Open Market Committee expect the first increase in the federal funds rate to occur in 2015 or 2016.2

BOND MARKET RETURNS

If interest rates rise at some point in the future, and you’re holding a disproportionate amount of your assets in fixed income/bond investments, you may have more risk in your portfolio than you realize.

For more complete information about variable annuities and variable investment options, call your properly registered financial professional for a prospectus. The prospectuses contain details on investment objectives, risks, fees and expenses, as well as other information about investment options, which you should carefully consider. Please read the prospectus before making any purchasing decisions.

1”Duration: What an Interest Rate Hike Could Do To Your Bond Portfolio,” FINRA Investors Alert, Investors Education Series, February 2013.

2”Transcript of Chairman Bernanke’s Press Conference,” Board of Governors of the Federal Reserve System, March 20, 2013.

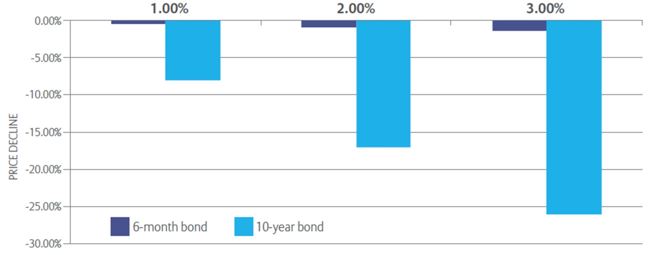

The longer the average term of a bond in a portfolio, the greater the interest rate risk you may bear.

This chart illustrates that bonds with longer durations (measure of time to the maturity of the bond) have greater interest rate risk than bonds with shorter durations. This difference in price volatility is the net result of the potential for an increasing interest rate environment. Shorter-maturity bonds offer the flexibility or opportunity to be reinvested if new, higher interest rates, are offered in the marketplace. Looking at the chart below: a rise in interest rates of 1% shows a decline of nearly 10% for a 10-year bond, a rise of 2% shows a decline of over 15%, and a rise of 3% shows a decline of over 25%.

HOW ARE BONDS AFFECTED IN AN INCREASING INTEREST RATE ENVIRONMENT?

Source: “Evaluation a Short-Duration Bond Strategy,” Market Analysis, Research & Education, March 8, 2011.

Source: “Evaluation a Short-Duration Bond Strategy,” Market Analysis, Research & Education, March 8, 2011.

If you’re five to ten years from retiring, you may not have the time to make up for any losses in your investments. If rising interest rates cause inflation, the purchasing power of your savings could be reduced, and possibly have a negative effect on your standard of living.

Annuities may be a practical solution for a portion of your retirement savings and income needs. Depending upon the particular annuity chosen, there may be an income rider offered, that may or may not have an additional cost. This income rider could be a solution for giving you an increasing income stream in retirement.

Annuities can be a solution to help you meet your long-term retirement goals, as they offer tax-deferred growth potential, a death benefit for your beneficiaries (available during the accumulation phase, and usually diminishing in the income phase,) and a guaranteed stream of income in retirement.

The purchase of an annuity is an important financial decision and you should fully consider the features, benefits, limitations and any fees that may be associated with the product prior to making a purchasing decision.

Annuities may be subject to holding periods and surrender charges, which vary by product and carrier.

Product availability varies by state and carrier.

Variable Annuities

You should think about the features, benefits, limitations, risks, and costs that may be associated with a particular variable annuity. Additional consideration should be given to the expenses, investment risks, and objectives of the underlying investment options in a variable annuity.

Now may be a good time to consider an fixed or fixed-indexed annuity from a life insurance company.

Different financial products have different purposes and risk levels. Please analyze your own goals before making a purchasing decision regarding any financial product.

This is not intended as legal or tax advice.

Surrender charges (early withdrawal penalties) may result in a loss of credited interest or contract gains and a loss of principal (your premium). Any distributions for annuities are subject to ordinary income tax and, if taken prior to age 59 ½, a 10% tax penalty for premature distribution may apply.

Any transaction that involves a recommendation to liquidate a securities product, including those within an IRA, 401(k), or other retirement plan, for the purchase of an annuity or for other similar purposes, can be conducted only by individuals currently affiliated with a properly registered broker/dealer or registered investment advisor. If you financial professional does not hold the appropriate registration, please consult with your own broker/dealer representative or registered investment advisor for guidance on your securities holdings.