Positioning For Change

Fixed index annuities as a core fixed income holding

Carsten Quitter and Aaron Sorbel

Fixed income funds have been an anchor for many clients’ portfolios. In asset allocation terms, financial professionals traditionally have placed a significant portion of clients’ assets in the relative safety of bonds, bond funds, CDs, money market funds, and other fixed income assets, with the traditional advice being to increase these holdings as a client ages, shifting assets from riskier equity funds.

Not all fixed income assets have interest rate sensitivity, but some instruments, such as certain bond funds, can have significant interest rate sensitivity.

Bond funds have generally served clients well – especially in the immediate aftermath of the economic crisis of 2008-2009, when equity markets were steeped in loss and fraught with volatility. Though bond funds were also negatively affected early in the crisis, they recovered more quickly than equities. Even as equity markets slowly recovered, bond funds continued to perform well.

But many investors and financial professionals have grown complacent with bond fund performance – so much so that the idea of losing money in their bond holdings has seemed inconceivable, or simply was never discussed. Because many, if not most, financial professionals suggest to clients that bond funds are a relatively “safe” investment, the client discussion usually never tends toward losses on bond holdings.

As 2013 has shown, investors now know all too well that some bond funds and other fixed income holdings can lose value, and are looking to their financial professionals for other options.

This challenge will likely continue for some time.

As the economic recovery takes hold, rising interest rates or a full pullback in the Federal Reserve’s quantitative easing program could have a negative effect on fixed income assets with interest rate sensitivity, such as bond funds. Because the road from economic recovery to prosperity is a long one, this rising interest rate environment could continue for many months if not years, potentially leading to ongoing disappointment with bond fund results and increasing the anxiety level for many financial professionals and their clients.

With bond funds feeling risky and equity markets feeling rich and volatile, financial professionals may feel confused over which way to point their clients. They are looking for options that offer returns and the relative safety of fixed income, but without downside risk from rising interest rates. For some financial professionals, this situation is reminiscent of the feelings of uncertainty that enveloped their clients in 2008 and 2009.

For the right clients who are approaching retirement but still have a mid- to long-term time horizon, fixed index annuities (FIAs) may offer a new anchor to the fixed income portion of their portfolio and serve as a core holding that may help both client and financial professional feel more confident about the portfolio.

FIAs are not for every client, nor is it suitable to put all assets into an FIA. But when looking at various hypothetical future interest rate and equity market movements, the FIA could perform well in both rising and falling interest rate environments, and under different equity performance scenarios.As with most financial vehicles, FIAs have fees, charges, liquidity restrictions, or possible tax implications. For the following analysis, these impacts aswellas transaction costs, fees, and tax implications of equities and bond funds have not been included so as to focus the analysis on the specific impact of interest rates and equity scenarios. This is not intended to be a comprehensive overview of these financial vehicles, so carefully review all details before recommending any product or investment to your clients.

Impact of interest rates on bond funds

Let’s focus on bond funds, a common fixed income holding, to investigate the impact of interest rates. As seen over the course of 2013, many bond funds have dropped in value due in part to a steadily rising interest rate environment. The return of a bond fund has two primary components: the price value of the bond holding, and the coupon paid on the bonds held in the fund.

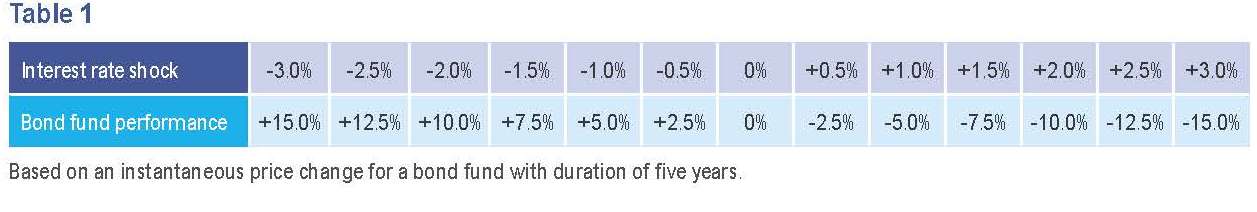

Table 1 looks at the impact of rising and falling interest rates on the price component of the bond fund’s return, based on a bond fund with a five-year duration. When interest rates fall, the effect on pricing can be very positive, and during the period of steadily declining interest rates in 2008-2012, bond funds were positively impacted.

But as interest rates rise, the drag on performance can also be significant. Table 1 also shows that a .50% increase in interest rates would put a -2.5% drag on the fund; at 1.0%, the drag is doubled to -5.0%. An increase of a full 3.0% would lead to a hefty -15.0% drag on the return on the average bond fund. These drags are calculated by multiplying the interest rate shock by our assumed duration of five years. Coupon payments from the bonds in the fund would partially offset this drag.

This negative pressure on bond funds could persist if the U.S. economy continues its recovery, the Federal Reserve pulls back on bond purchases and loose-money policies, and the growth rate of the economy eventually spikes, leading the Fed to tighten its money policy. Investors and their financial professionals may be looking now for some form of protection from this environment

Reviewing how an FIA works

So how might a fixed index annuity act as a hedge or “core” fixed income holding in a portfolio? Understanding the key components of an FIA is an essential first step.

FIAs are designed to meet long-term needs for retirement income. They provide guarantees against the loss of principal and credited interest, and the reassurance of a death benefit for beneficiaries. An FIA offers the potential to earn interest by linking the interest crediting to the return of a specific market index, such as an equity index. The interest credit is typically subject to a cap, spread, or other limiting factor.

With an FIA, the client is never directly invested in the equity markets. In very simple terms, the insurance company links the client’s money to the chosen market index performance. The company uses the options market to match their investments to the client’s money. While a majority of the contract owner’s premium is generally placed into a high-quality investment portfolio, a small portion is used to purchase an option.

For example, for an FIA with our annual point-to-point crediting method (with a cap), if the index is up at the end of the FIA’s contract year, the client is credited the growth of that index in interest up to the current cap. If the selected index declines over the year, the options expire worthless, and the customer is credited no interest (0%) on the account.

The client cannot lose money on the contract due to market performance if it is held past the annuity’s surrender charge period. The interest potential for the client, however, is capped in the annuity contract. At year-end 2013, at prevailing rates, caps on FIAs were around 4%.

Looking at the Evidence

What can a client anticipate from an FIA in various interest rate and market scenarios over one year? Tables 2-4 below show how up or down movements of 5% annually in the equity market and interest rate changes of plus or minus 1% could impact a fixed index annuity (with a 4% cap), equities (with an assumed 2% dividend yield), and bond funds (represented by a bond with five-year duration and 2.5% yield).

Table 2 shows that in an up equity market reflecting a 5% gain, the maximum credited interest rate for an FIA is limited to 4% during a one-year period, which reflects a pre-set cap on the credited interest rate.

In an equity market that drops 5% or even more, the intrinsic guarantee of the annuity protects the contract owner against loss of principal, regardless of index performance. In short, while the interest potential of an FIA is limited, the principal is guaranteed not to go below the original investment.3 Also, the FIA is not directly affected by interest rate changes in up or down markets as long as the contract is held past the annuity’s surrender charge period. During the surrender charge period, some annuity contracts have a market value adjustment, which results in their surrender charge increasing or decreasing based on changes in interest rates.

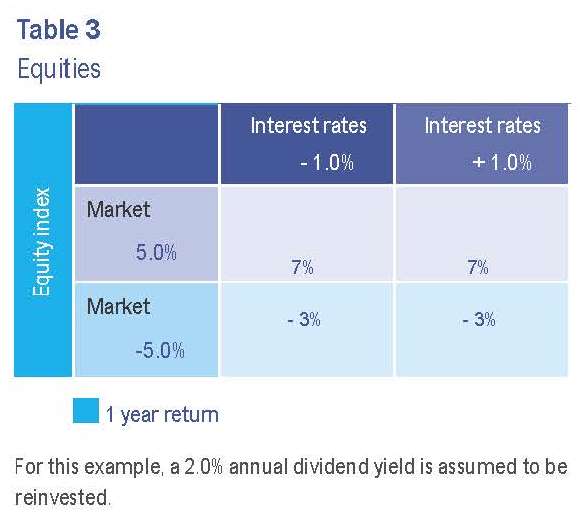

Table 3 shows that with an upward market move of 5%, stocks rise by 5%, regardless of interest rate movements. When added to a 2% dividend yield earned throughout the year, that makes a 7% year-over-year return. Conversely, when the equity market moves down by 5%, stocks fall by the same amount, and remain unaffected by interest rates. Adding in the 2% dividend yield makes for an annual return of -3%.

In up markets, the equity index may outperform the FIA, which has a preset 4% credited interest rate cap for gains. However, in down markets, the FIA offers principal protection so the contact owner’s principal is protected against market loss. Consequently, when the markets are down, equity investors take the full brunt of a loss; in this example, -3%.

Table 4 shows that the direction of the equity market has no impact on bond funds. A 1.0% drop in interest rates provides a 5.0% instantaneous lift on the price component of a five-year bond fund. However, the new annual yield would reflect the lower interest rate, so that the annual yield would become 1.5%. Therefore the annual return is 6.5%.

But when interest rates rise 1.0%, bond funds face a 5.0% drag, regardless of the direction of the equity markets. This is partially offset by the 3.5% annual yield and the resulting annual return is -1.5%. (Note that the yield has increased from 2.5% to 3.5% to reflect the higher-yielding bonds now in the portfolio after interest rates increased.) Interest rate moves higher than 1% would create a larger negative drag on the bond fund.

The other financial vehicle options shown in this analysis – FIAs and equities – can provide a respite from rising interest rate worries. Rising interest rate scenarios can lead to losses for bond fund investors. No loss occurs for those who purchased an FIA because principal is guaranteed against market losses.

Conclusion

Bond funds have been solid investments for many years and fixed income investments should continue to be part of a well-balanced portfolio for most clients. But with 2013’s rising interest rate environment, certain bond funds have lost some of their “safe haven” status with financial professionals and their clients. For many investors, losses in their bond fund values are very real. When helping clients reallocate funds, financial professionals must evaluate contenders based on how well they fit within the fixed allocation of the client’s portfolio and whether they are appropriate for the client.

Some clients, particularly those who are newly retired or transitioning to retirement, could be especially vulnerable to rising interest rates that may hit bond funds. Many vividly remember the pain of their equity losses during the 2008-2009 economic crisis. Now some bond funds, which many investors may have mistakenly believed were a “safe” investment that could not lose value, are the center of new concerns about losses.

To what option should a financial professional point clients who are in need of a conservative asset to temper their fixed income losses and complement their risk tolerance? As shown above, a fixed index annuity can protect against a market downturn and could provide interest earnings in rising interest rate and equity markets. The FIA may be appropriate for a portion of a portfolio’s core fixed income holdings.

Additional FIA benefits

In addition to growth potential, an FIA is a conservative financial instrument that:

- Offers a level of safety and certainty in a volatile marketplace. An FIA has a guarantee that protects against loss of principal due to market downturn. However, upside interest potential is typically limited to a pre-set cap or by a pre-set spread. Keep in mind that the guarantees of the annuity are backed by the claims-paying ability of the insurer.

- Is not directly affected by interest rate changes. Rising and falling interest rates have no immediate direct impact on an FIA utilizing an equity index allocation option.

- Provides tax-deferred interest. Tax deferral is a feature of all annuities.

- Can provide an income stream. The FIA can be a source of guaranteed retirement income when annuitized or purchased with an optional income rider

- Offers upside interest potential that may change annually. An FIA’s upside interest potential is typically linked to the performance of an external market index and subject to change on an annual basis.

- Has surrender periods of six to 10 years. Annuities are designed for retirement income and have surrender periods that vary by product. Partial access is typically available during the 6- to 10-year surrender period, but excess withdrawals can incur a penalty.

- A persistently rising interest rate environment could have significant negative impacts on performance of certain bond funds. Though not right for all, a fixed index annuity can offer a potential hedge against uncertainty for the right clients looking to protect a portion of their portfolios from rising interest rates.